Abrigo's DiCOM Loan Review software enables banks and credit unions to identify emerging credit risks, achieve double-digit efficiency gains, and reduce losses through a streamlined, automated loan review software process.

Portfolio Risk & CECL

Subscribe to our Newsletter

SubscribeKeep Me Informed

Stay up-to-date on industry knowledge and solutions from Abrigo.

Gain deeper insights with an efficient process

Loan Review Software

Loan review workflow automation

Streamline loan review for banks and credit unions.

Optimize loan review

Identifying portfolio risk is vital to running a high-performing financial institution. With Abrigo's DiCOM Loan Review software, credit union and bank loan review services are more efficient. Credit review staff can more easily ensure that underwriting and portfolio management align with risk appetite and expectations.

Learn moreAdvantages of DiCOM Loan Review software

Automate your credit risk review process.

Easily identify risk

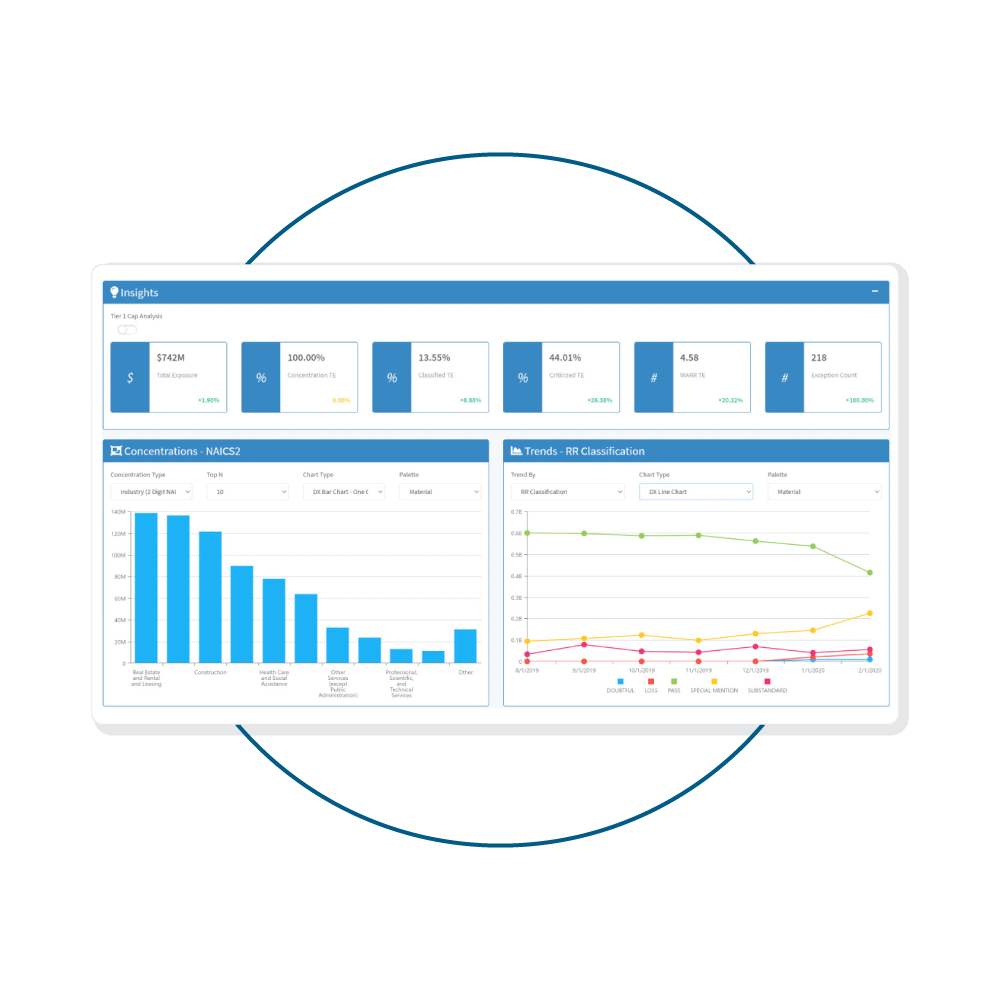

Find emerging portfolio risk pools and mitigate potential credit quality deterioration through dynamic risk assessments and automated scoping that creates risk-based samples in minutes.

Achieve efficiency gains

Free up time and ensure consistent loan reviews with automated data integration, customizable workflows, and dashboards showing performance by segment, teams, and more.

Reduce losses

Identify problem loans with vigorous reporting that gives visibility across a range of loan data. Make better decisions using summaries of reviews, exceptions, and portfolio concentrations.

Instill confidence in the loan review process.

Quality reviews

Impress your board, management, and examiners with efficient and effective credit risk reviews that identify risks and reinforce consistent underwriting and controls.

Accurate data

Quickly get the data your loan review team needs and save time previously spent on gathering or entering loan information through the integration with Abrigo's lending and portfolio risk platform.

Better process, better bank

“DiCOM’s loan review and portfolio analytics have provided our credit risk review function with streamlined processes, improved efficiencies, enhanced scoping capabilities, automated line sheets, robust management reporting, and critical portfolio analytics.” -Eastern Bank

Integrated systems with Abrigo

Streamline credit spreading

Sageworks Credit Analysis

Make smarter, faster credit decisions by automating your credit underwriting process with Abrigo's credit analysis software. Ensure analysts only enter data once in Sageworks and have it populate customer information across the platform, allowing them to enforce the financial institution’s credit policies in a digital lending environment.

Explore the Product