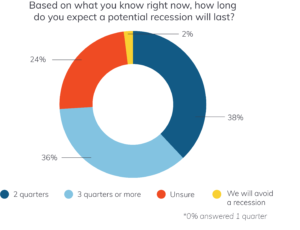

Although it’s still early, bankers have started to make their own assumptions about the impact the coronavirus pandemic will have on the economy and their institutions. In fact, three out of four bankers expect a recession will last at least two quarters.

In an informal poll during the webinar, Optimizing CECL: Moving from No Losses to an Integrated Risk Profile, attendees were asked how long they expect a potential recession to last. Nearly three out of four attendees expect that a recession could last two quarters or more (74%). The poll also highlighted the uncertainty of the situation, with almost a quarter of attendees responding that they were unsure (24%).

These results show that bankers are expecting the crisis to be slower emerging, and the systemic effects will be a bit longer, Garver Moore, Managing Director of Advisory Services at Abrigo, explained during the webinar. “The sooner we can decrease the uncertainty, the sooner we can all move on and manage what happened,” Moore said.

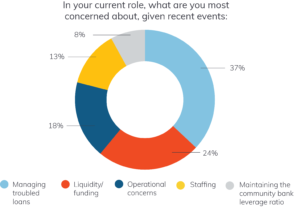

When it comes to the potential impact that the pandemic might have on financial institutions, managing troubled loans and liquidity and funding (24%) top the list of concerns for bankers, according to another poll question during the webinar. Nearly a third of attendees cited operational concerns (18%) or staffing concerns (13%) as their top worry.

When it comes to the potential impact that the pandemic might have on financial institutions, managing troubled loans and liquidity and funding (24%) top the list of concerns for bankers, according to another poll question during the webinar. Nearly a third of attendees cited operational concerns (18%) or staffing concerns (13%) as their top worry.