When a financial institution’s credit risk decisioning process has redundant data entry, separate systems, and subjective risk ratings, it means bottlenecks for fast-paced lending teams and increased risk. Our credit risk software helps institutions make defensible credit decisions with speed and precision on one connected system.

Lending and Credit Risk

- Community Lending

- Commercial Lending Software

- Consumer Lending Software

- Small Business Lending Software

- Construction Lending

- Credit Risk Software

Get Updates from Abrigo

SubscribeKeep Me Informed

Stay up-to-date on industry knowledge and solutions from Abrigo.

Credit Risk Management Software

Reduce lending bottlenecks; enhance credit analysis.

Streamlined Decisions

From underwriting to closing, Abrigo’s credit risk software ensures one-time data entry and shortens time lost to the back-and-forth between teams. We streamline credit spreading, risk rating, pricing, and servicing. You get consistent application of your credit policies on a scalable, life-of-loan platform.

Play VideoFeatures and functionality of credit risk software

Spend more time building relationships and analysis, less on manual tasks.

Many community banks and credit unions face inconsistent workflows and disconnected data systems during underwriting and loan approval. Abrigo’s credit risk management software automates rote tasks and reporting so credit staff can focus more on valuable activities like analysis and trendspotting.

No Data Entry

Save time and allow the credit team to spend time on analysis rather than on entering information line by line.

Uniform Credit Process

Standardize analysis and documentation for defensible reports for loan committee meetings, loan reviews.

Accurate Analysis

Leverage global cash flow analysis to assess complex entities’ income and debt compared to industry peers.

Effective Administration

Automate tickler updates and track covenant/document exceptions to cut loan review preparation time and costs.

Better Loan Pricing

Apply risk- and target-based pricing scenarios coupled with key benchmarks to validate loan pricing strategy.

Data-Informed Decisions

Leverage projections and proprietary industry data to make more informed C&I, CRE, and MBL loan decisions.

Uniform Credit Analysis Process

“Abrigo’s global analysis ensures accuracy, and the narrative reports provide time-savings and consistency. Our examiners have commented that they like the uniformity our software solution provides to our credit analysis.” Read More.

Kevin Atwood, EVP, Bank of Cadiz and Trust Company

Advantages of credit risk software

Pioneering tools and in-house team to support your credit risk decisioning needs.

Along with providing you a more efficient underwriting process, your software partner should be committed to improving the product over time with new and exciting technologies. The age of digitization is upon us, and partnering with experienced innovators is critical for banks and credit unions starting or boosting digitalization. And with Abrigo’s strong industry experts and support team, you will be all set!

Award-Winning

Implementation & Support

When automating, it's important to get the right training and templates in place to utilize the new solution effectively. Abrigo's implementation team is committed to getting you stood up rapidly and successfully, utilizing the best practices of over 2,300 customers. Our support satisfaction backs this up.

Constant Innovation

Abrigo consistently works to make solutions even more effective for banks and credit unions. We’ve created patented technologies like the Electronic Tax Return Reader, which can spread tax returns in less than a minute with 100% accuracy.

Dedicated Partnership

Our customers will tell you Abrigo is more than just a vendor; we are a partner dedicated to your institution’s success. That’s why we constantly solicit feedback from customers and seek ideas for new features to meet your changing needs.

Award-Winning Products - All-in-one-Solution

Credit Analysis

Spread loans quickly to understand borrower’s global cash flow and credit risk compared to industry peers.

Risk Rating

Use single, dynamic, and comprehensive risk rating methods to identify problem loans early.

Electronic Tax Return Reader

Spread tax returns in under a minute, preventing lenders from having to key in the data.

Loan Administration

Automate client correspondence to reduce the time and cost of loan review an average of 35%.

Document Prep

Generate compliant loan documentation using loan information already in the platform.

Loan Pricing

Make more informed pricing decisions that accurately capture costs of making the loan.

Workflow

Utilize customized templates and steps to match your loan management needs.

Document Library

Securely store key documents by centralizing them for users who need access.

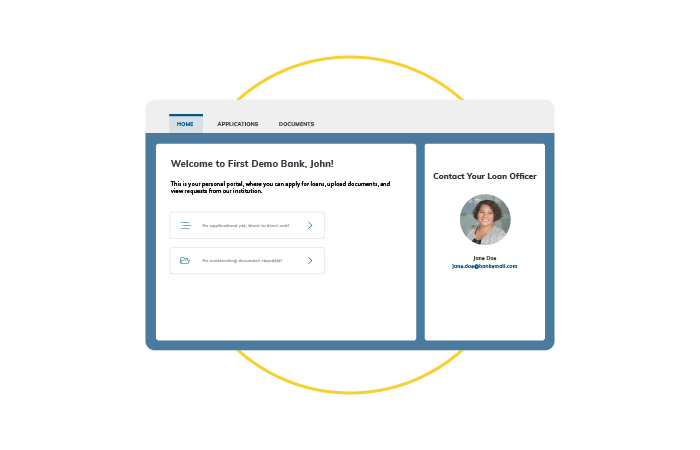

Client Portal

Collect documents using a secure portal and stop tracking down files one by one.

“We now have reports that give us real-time information to make business decisions that work better for everyone. The reporting available will allow the bank to move forward with loan administration and monitoring in a more efficient manner.”

Jason Soto, Chief Credit Officer, Webster Bank

Get a Demo

Integrated Solutions with Abrigo

Deliver a Modern Customer Experience

Dynamic Application

To effectively compete in the current market and foster growth, financial institutions must have a digital presence. The Sageworks Dynamic Application increases efficiency for staff and allows borrowers to complete applications at their convenience online through a modernized interface.

Resources on Credit Risk

Risk Rating Considerations

Recommendations based on regulatory guidance for an effective risk rating system.

Credit Risk Best Practices

Learn about best practices for effectively managing risk in the portfolio during a recession.

Key Credit Analyst Traits

Successful credit analysts should have these four core qualities that set them apart.