Financial institution executives are expressing heightened concerns about risks related to interest rates, credit, and liquidity. These worries only add to the many challenges they face. How can banks and credit unions quickly spot warning signs so they can act during volatile economic, industry, and institutional conditions?

Data-driven decisions are crucial for managing risk in financial institutions. This is especially true in light of recent failures, such as Silicon Valley Bank, First Republic Bank, and Signature Bank of New York. These events highlight the need for effective strategies that drive growth and increase efficiency. With headlines like “banking crisis” and “bank runs,” customers or members, employees, and other stakeholders are looking for any sign that another bank or credit union is in trouble -- even if the institution is not facing the unique circumstances leading to those banks’ collapses. Naturally, all financial institutions come under increased regulatory scrutiny after such newsworthy events as those, too.

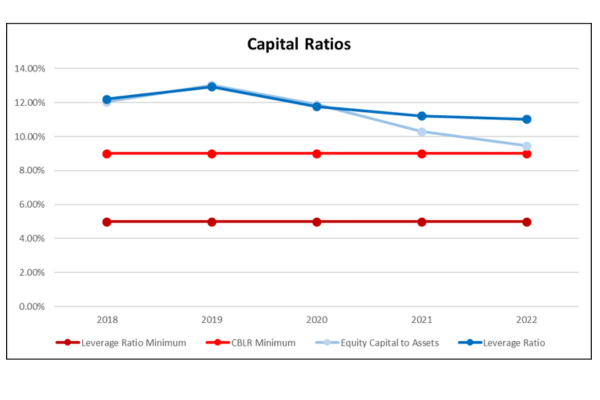

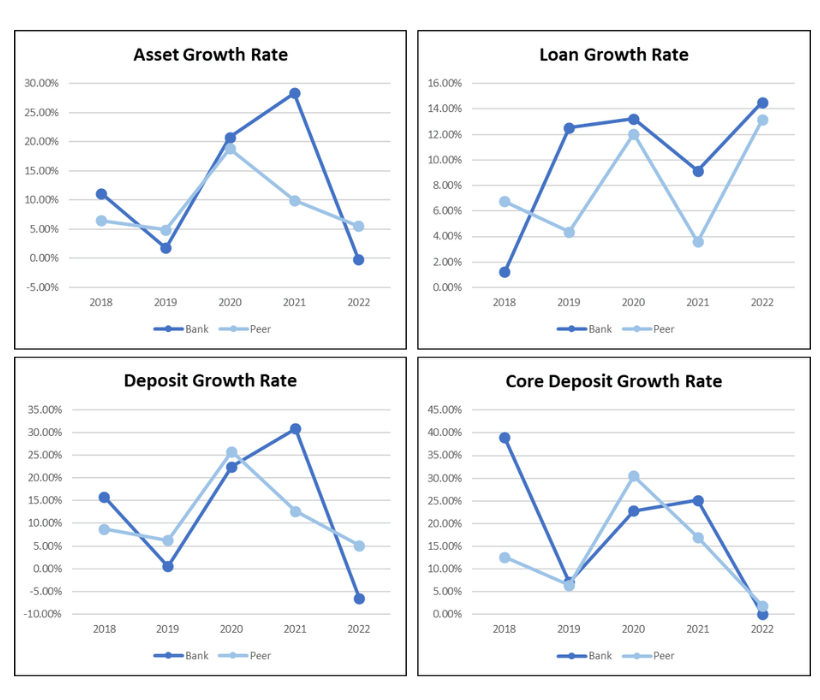

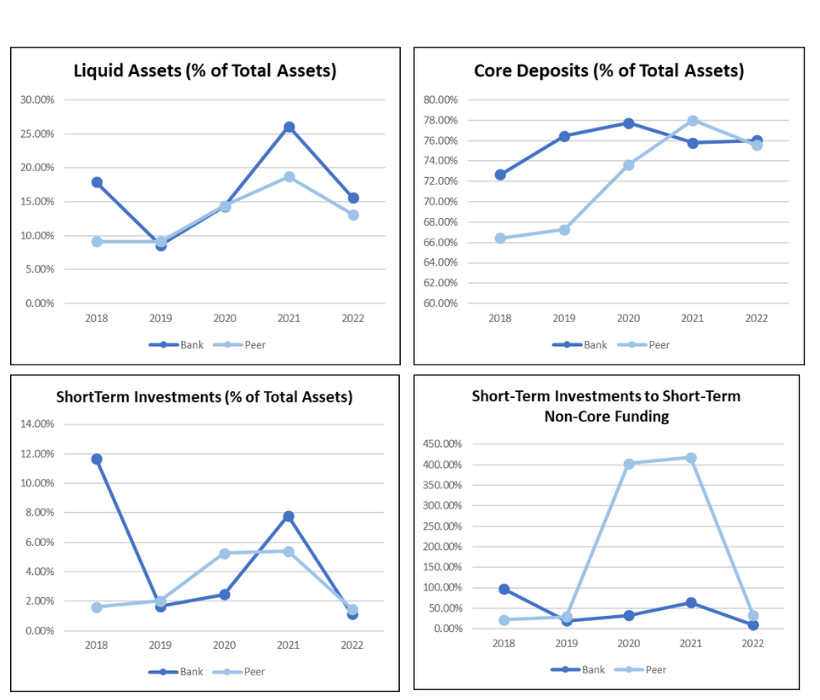

Furthermore, even before the recent banking issues, regulators emphasized the need for financial institutions to keep their leaders informed. This includes critical aspects of planning, operations, and risk management. An OCC Reference Guide to Board Reports and Information, for example, says that “directors should look at individual, peer, and industry performance measures as well as the trend and interrelationships among capital, asset quality, earnings, liquidity, sensitivity to market risk, and balance-sheet changes.”