AI adoption is accelerating, but not without barriers

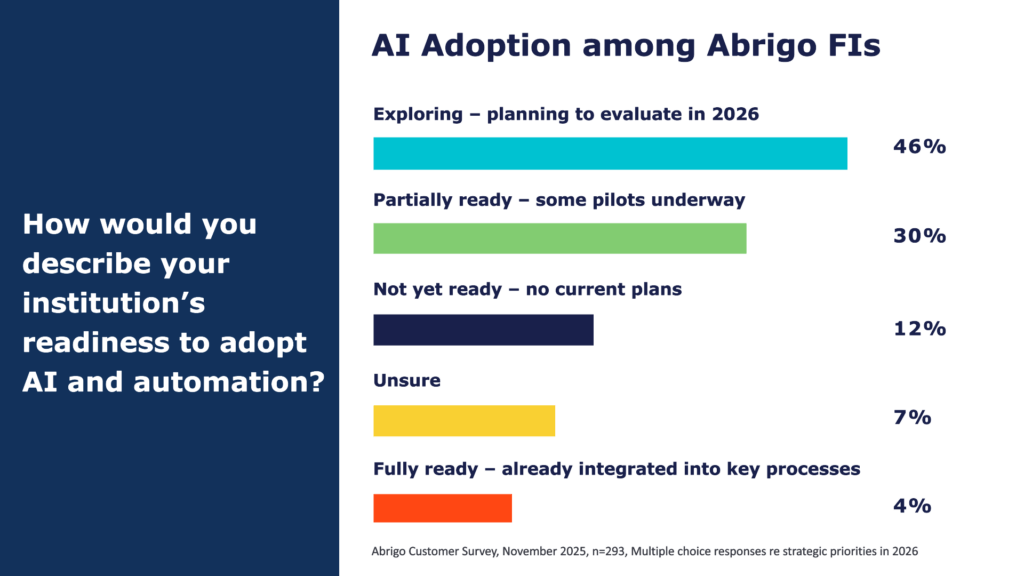

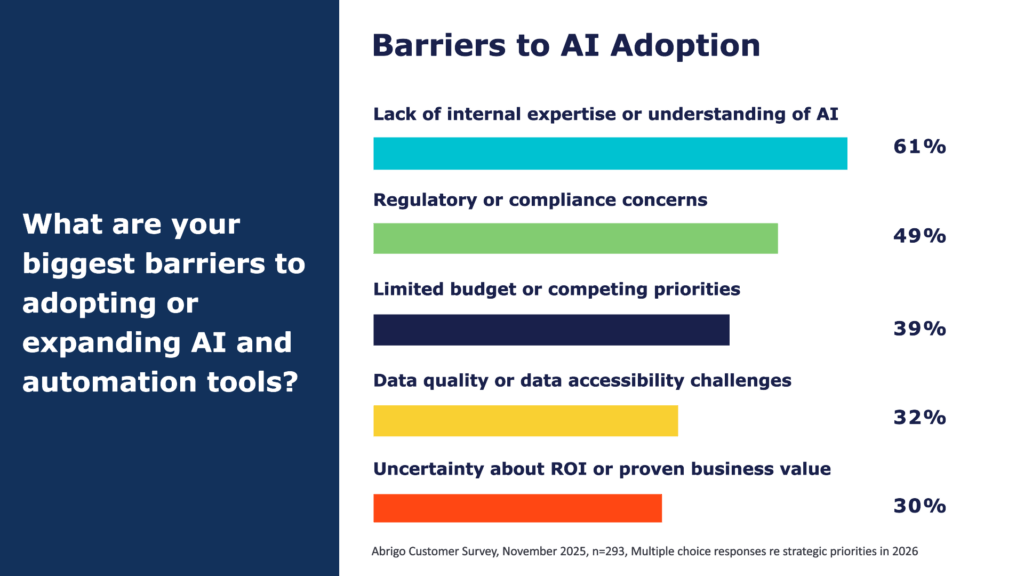

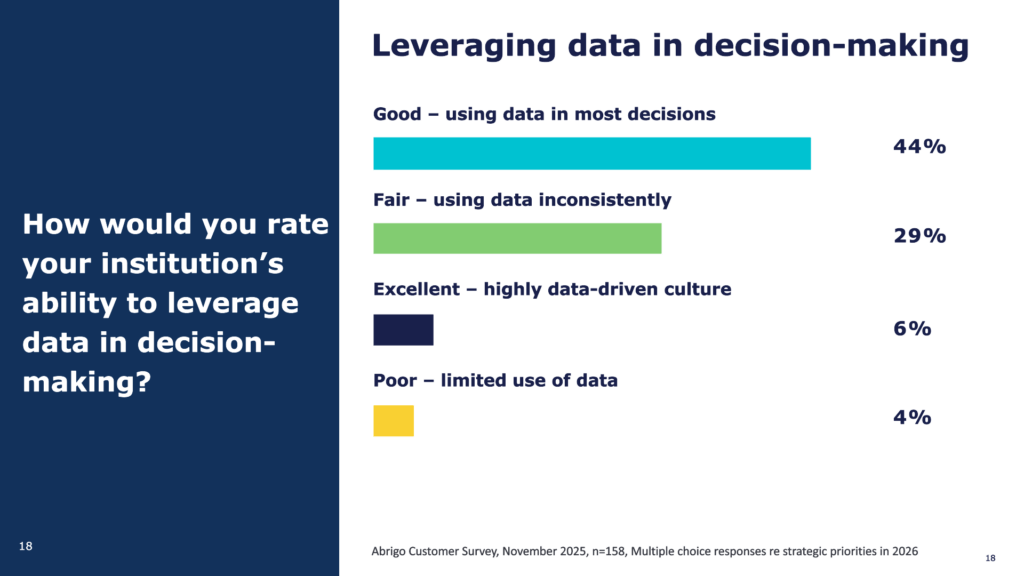

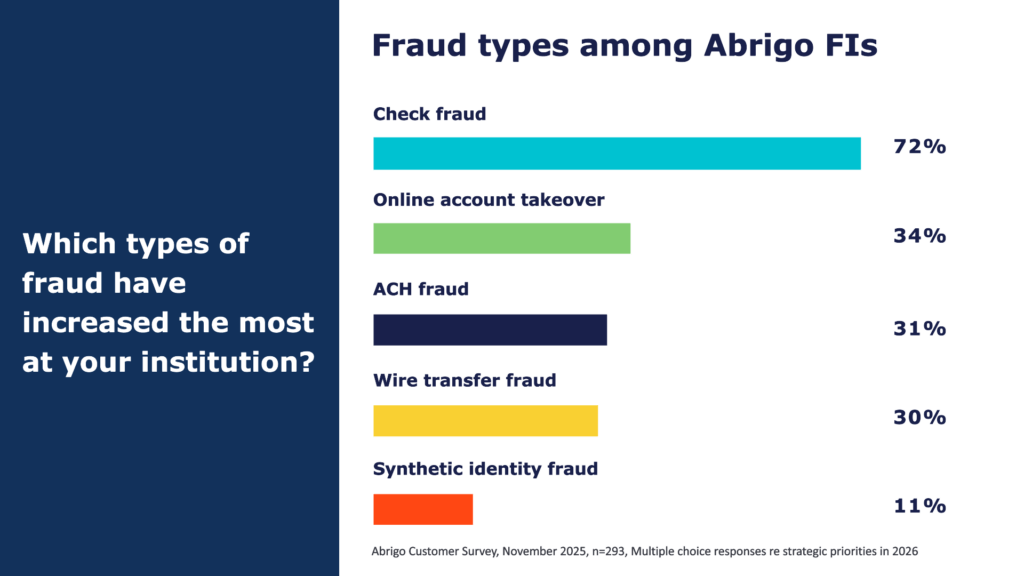

The pace of AI implementation continues to pick up, with more than 75% of surveyed institutions reporting they are adopting or planning to adopt AI tools in 2026—a threefold increase from the previous year. Popular use cases include loan decisioning, fraud monitoring, allowance narratives, and onboarding efficiencies. However, barriers remain. Top concerns include data quality, limited internal expertise, and regulatory uncertainty. Community financial institution priorities in 2026 must include upskilling teams and implementing AI in controlled, explainable ways to meet operational goals and regulator expectations.