CECL Progress: Poll Shows Many Financial Institutions Have Implementation Committees

**Please check our most recent blog post regarding the latest changes to the FASB deadlines.**

As 2017 comes to a close, it is a good time for financial institutions to assess where they are in the process of implementing the Financial Accounting Standards Board’s new current expected credit loss (CECL) model.

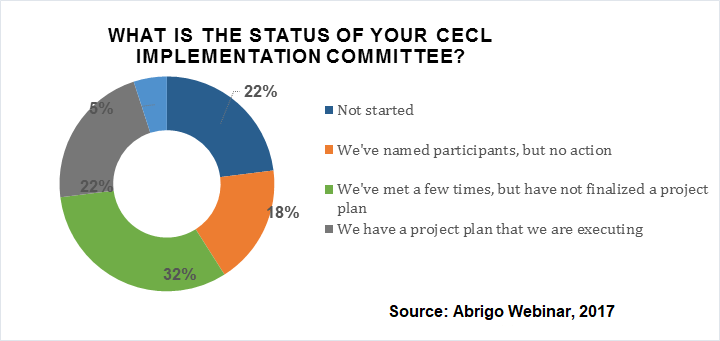

Based on a poll conducted recently by Abrigo, most financial institutions at a minimum have formed a CECL implementation committee. Even so, nearly 1 in every 4 surveyed had not created a committee. The implementation committee is an important early step to evaluate the scope of implementing CECL, to understand the costs associated with transitioning, and to create a project plan and implementation timeline.

During the webinar, “CECL – The relationship between credit and finance,” 172 respondents were asked for the status of their CECL implementation committee. Among respondents:

• 32 percent said their CECL implementation committee has met a few times but hasn’t finalized a project plan

• 22 percent said their committee has a project plan that the institution is executing

• 18 percent reported having named participants to the implementation committee but having taken no action.

Only 23 percent reported they have not started a CECL implementation committee and 5 percent didn’t know or aren’t involved.

Abrigo Executive Risk Management Consultant Tim McPeak said he would be interested to know how banks’ responses to the question correlated to their size. “Broadly speaking, our experience to date has been that the larger institutions have been a little bit further ahead in the planning process,” he said. SEC-filing banks, in particular, to some degree probably have a little bit more pressure from a timing standpoint, he added.

Learn more about navigating the CECL transition.

Nevertheless, McPeak said he wasn’t entirely surprised that a majority of poll respondents reported that their implementation committees have met a few times but haven’t finalized a project plan. “They are still kind of figuring things out,” he said. “I don’t think that’s a bad place to be in 2017. Though time is definitely ticking away here, there is still some time, and in thinking about this, the size and complexity of your institution does matter in determining what steps need to be taken when. Also I think to some degree, SEC filing banks particularly have a little bit more pressure from a timing standpoint.”

“Not having every detail of your project plan does not mean you are behind at this point,” he added. “However, now is the time to move into thinking through these things.”

The earliest CECL takes effect is in 2020 for SEC-registered institutions, but many bank and credit union executives understand the importance of taking steps early in order to be ready, given the complexity of the accounting standard, based on previous polls by Abrigo. In 2016, 42 percent of professionals attending another Abrigo webinar believed institutions should be executing preliminary CECL calculations by Q4 2017.

Learn more about navigating the CECL transition.

CECL implementation committees, according to McPeak and other Abrigo consultants, should likely include senior staff from several departments, including finance, credit, risk management IT, and audit. Even if all of these committee members don’t realize today how the allowance for loan and lease losses (ALLL) affects their department, they may be impacted by CECL’s requirements and will play an important role in executing a calculation under the new model.

Establishing group objectives and key milestones can help CECL committees identify the intermediary steps of the institution’s implementation project plan. CECL committees can also identify which parties will be accountable for the plan’s various pieces.

Learn more about preparing for CECL by listening to the on-demand webinar, CECL – The relationship between credit and finance.