CECL Q&A – Segmentation

The FASB’s Current Expected Credit Loss (CECL) model presents unique challenges for banking professionals. To help institutions prepare, Abrigo launched a CECL webinar series covering data, segmentation, methodology, and forecasting requirements broken down by loan pool-type. A key component of the series is allowing participants to ask their CECL-related questions and below are several segmentation considerations as well as questions and answers relating to segmentation.

“Loan pool segmentation is a current challenge bankers face and one they will continue to face as they transition to an expected loss model. It is a balancing act; specifically, making sure that the pools’ loans have similar characteristics while also having granularity and being statistically significant,” said Abrigo Director of Consulting Aaron Lenhart.

Proper Segmentation (326-20-30-2)

Segmentations or pools should have similar risk characteristics. These pools should be as granular as possible while maintaining statistical significance. Management will need to evaluate pools on an ongoing basis to ensure that the underlying assets continue to exhibit similar risk behavior.

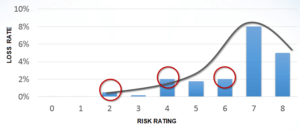

Improper segmentation can shift overall loss rates and would not be truly representative of actual losses under proper segmentation.

We presently segment our pooled loans by loan type (collateral) and then risk rating. Under CECL would you anticipate segmenting by product type, then collateral type and then risk rating?

There is no guidance or commentary that says you cannot approach segmentation this way. Usually, I encourage two levels of segmentation. So the principal would be to choose a type of loan and then sub-segment by a risk metric for example FICO for consumer pools, and risk rating in my commercial pools.

Can we simply break out our loan pools by call code?

Absolutely. One of the benefits is that there is readily available annual loss data available by call code for peer and relational testing. The use case for those annual losses is pretty minimal for doing a CECL calculation. If you are using a DCF model, that can then turn those annual losses into a lifetime calculation based on your institution’s amortization schedule then segmenting by call code would be appropriate.

If you are interested in more answers to CECL, watch the on-demand webinar, CECL Methodology Q&A.