With the expected ongoing increases in market rates, many institutions hope to improve net interest margin via an increase in yield on earning assets outstripping any increases in funding costs. However, in prior rising-rate environments, this expected gain was often not as big as it was modeled in an asset/liability management (ALM) model.

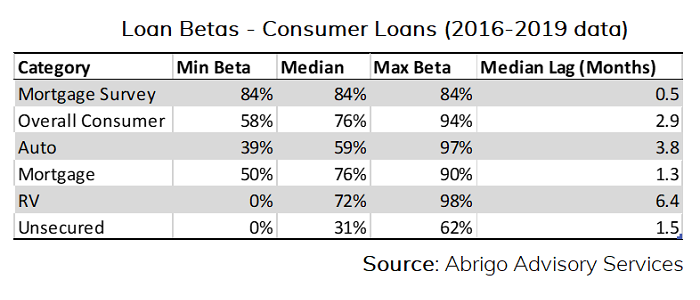

Why is that? The reason is that the true loan betas, or the actual increase in yields earned, do not fully match the increases in market rates. When I ask about the projected betas used in modeling, I'm often told they are assumed to be 1, meaning any new assets booked or repriced will adjust at 100% of recent market rate increases.