In an ideal world, all of the money that banks lend out to borrowers would be paid back at its maturity date. However, that’s not always the case, as there are three inherent risks all financial intermediaries face: credit risk, interest rate risk, and liquidity risk. To account for these inherent risks, as well as other risks, financial institutions must develop a sophisticated loan grading system to protect their institution and grow safely and soundly.

Accurate and timely loan grading is critical for any loan review system. This requires institutions to identify loans with potential credit weaknesses, grade loans appropriately so that credit losses can be minimized and provide management with accurate and timely credit quality information for financial and regulatory reporting purposes, including the determination of an appropriate ALLL.

There are many variables for financial institutions to consider when determining a loan portfolio’s risk, as well as how to mitigate those risks.

Underwriting vs. Loan Grading

Some people get confused when it comes to the difference between underwriting risk scoring and loan grading, but it really comes down to timing, notes Rob Newberry, Principal-Product at Abrigo, during a recent webinar. “If you look at a loan grading system prior to actually writing a credit, that’s going to fit more under underwriting a risk-rating decision, and once the loan is on your books, then it becomes more of a loan grading decision.”

When your institution is underwriting a loan, it may approve or deny it upfront depending on the risk. If the loan carries a significant amount of risk, the institution may choose to approve it, but mitigate the risk with additional covenants or through loan pricing. Once it’s on the books, however, loan grading comes into play, and the institution is assessing the performance of that credit and how it may impact its reserves.

Pay vs. Save Strategies

There are strategies that financial institutions can employ to mitigate lending risks, such as pay and save strategies.

Pay strategies assess the ability of a borrower to pay back his or her loan obligation. This primarily looks into the financial background of the borrower to understand the feasibility of the borrower to make payments. Common ratios used to assess pay strategies include debt service ratio, current ratio, debt to net worth, and individual credit score (FICO).

Save strategies, on the other hand, aim to mitigate the amount of losses incurred if the borrower were to stop making payments. From a save strategy perspective, you want to have enough collateral left to cover remaining loan payments. Common items used in save strategies include loan-to-value (LTV) or collateral-based lending, personal guarantors, or coborrowers.

Subjective vs. Objective Analysis

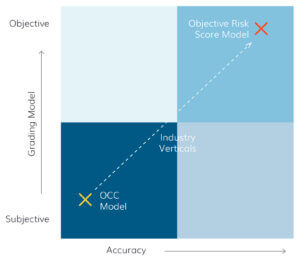

In an ideal loan grading calculation, financial institutions would use a combination of objective, comparative, and subjective analysis. Finding the balance between black box solutions, or objective analysis, and purely subjective grading systems, which rely on things such as strength of guarantors, management evaluation, and other credit quality adjustments (the 5 Cs), your institution can implement a dual loan grading system.

In an ideal loan grading calculation, financial institutions would use a combination of objective, comparative, and subjective analysis. Finding the balance between black box solutions, or objective analysis, and purely subjective grading systems, which rely on things such as strength of guarantors, management evaluation, and other credit quality adjustments (the 5 Cs), your institution can implement a dual loan grading system.

As for the loan grading scale itself, consider how compressed your institution’s sale is. Does it contain one to three categories? Perhaps, four to nine? Maybe even more than 10?

Prior to the financial crisis, many financial institutions used a five or six loan grading scale, which required split classifications, specifically around special mentions.