What are the current risks to construction lenders?

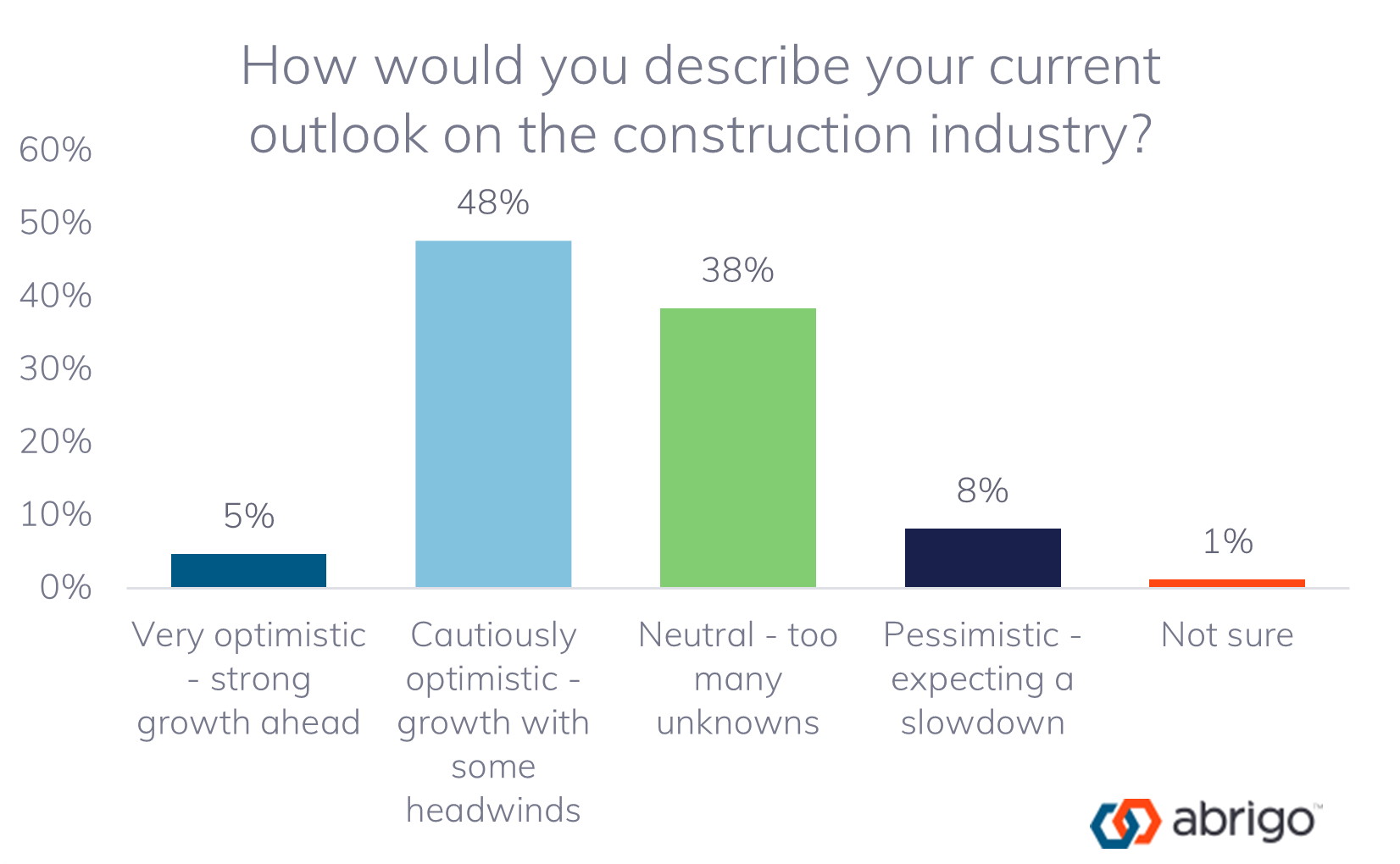

The construction industry continues to show cautious optimism, but sentiment surveys and lender experiences reveal headwinds that should be on every lender’s radar.

“The beauty of the construction industry is there are always going to be opportunities; there are always going to be projects,” said Brian Kassalen, CPA, CFF, CCIFP, and Construction Industry Practice Leader at Baker Tilly, during a recent webinar hosted by Abrigo. Specifically, Baker Tilly is seeing new projects in civil infrastructure, power generation, data centers, educational and institutional health care facilities.

At the same time, he said, many of the thousands of contractors nationwide are dealing with persistent labor shortages and pressures in material costs.

Industry indexes, such as the CFMA Confindex and the FMI Nonresidential Construction Index, both reflect this cautious optimism, showing improvement in current backlogs but concern about the future pipeline, profit margins, and financing conditions. A poll of lenders attending Abrigo's webinar found most are cautiously optimistic about the construction industry outlook.

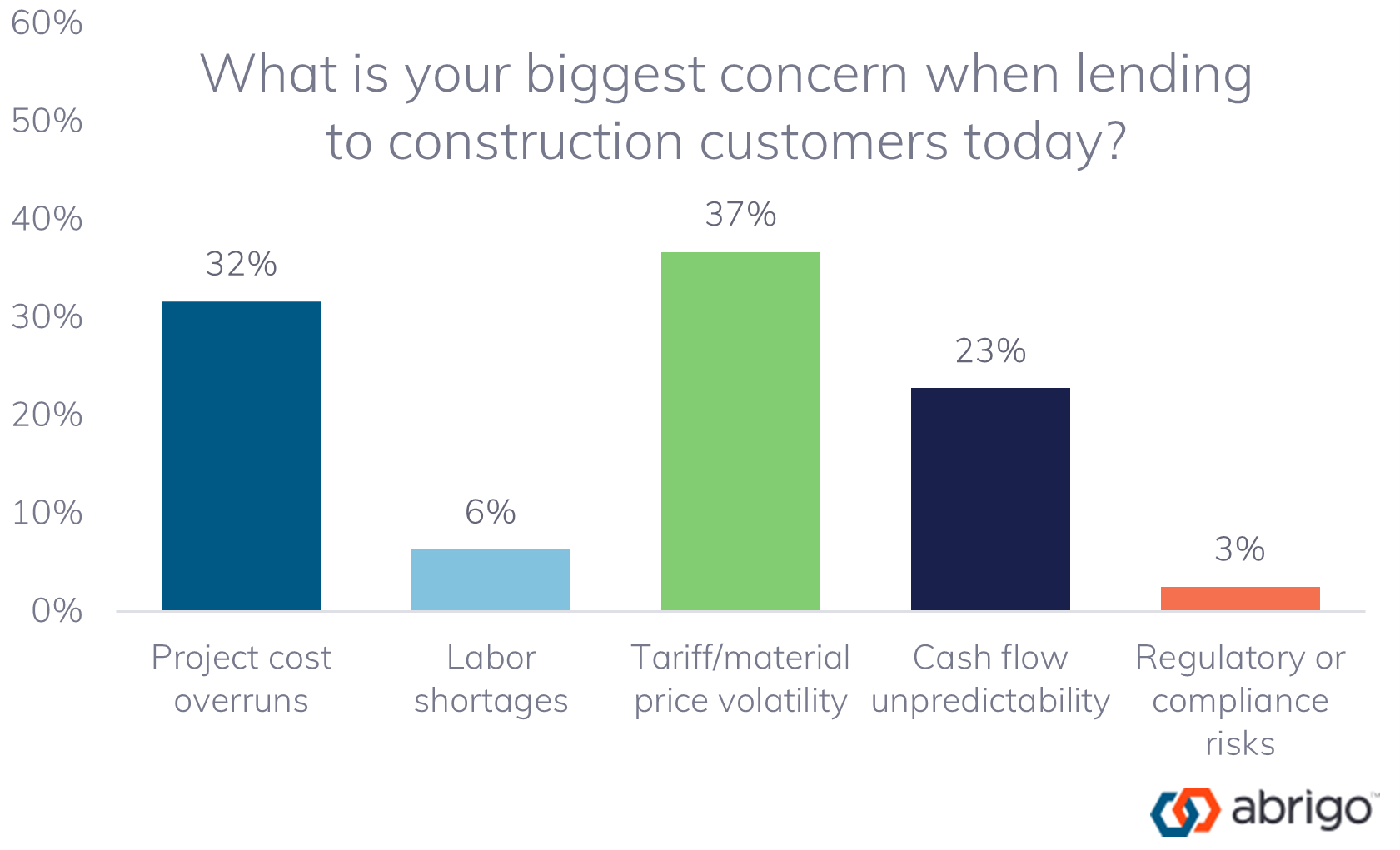

Among the most pressing risks for lenders, according to Kassalen:

- Tariff and material price volatility: Shifts in input costs affect contractors’ ability to bid accurately and complete jobs profitably.

- Cash flow timing: Contractors often pay vendors and crews faster than they receive payment, increasing the likelihood of liquidity challenges.

- Project cost overruns: Whether due to under-scoped budgets or rising labor costs, these overruns can reduce or eliminate a borrower’s profit margin.

- Uncertain economic indicators: Although some backlogs are growing, indexes show that confidence in both the U.S. and local economies is mixed, and signs of a slowdown are surfacing.

Abrigo's poll identified concerns related to pricing and project overruns.