Member business lending: The new rule

In an increasingly competitive banking environment, many banks and credit unions are re-evaluating their lending portfolios to see where they might have strong opportunities for competitive growth. For many, that area is Small to Medium Business Lending and Commercial Real Estate. For credit unions specifically, this is an area both of great opportunity and unique challenges.

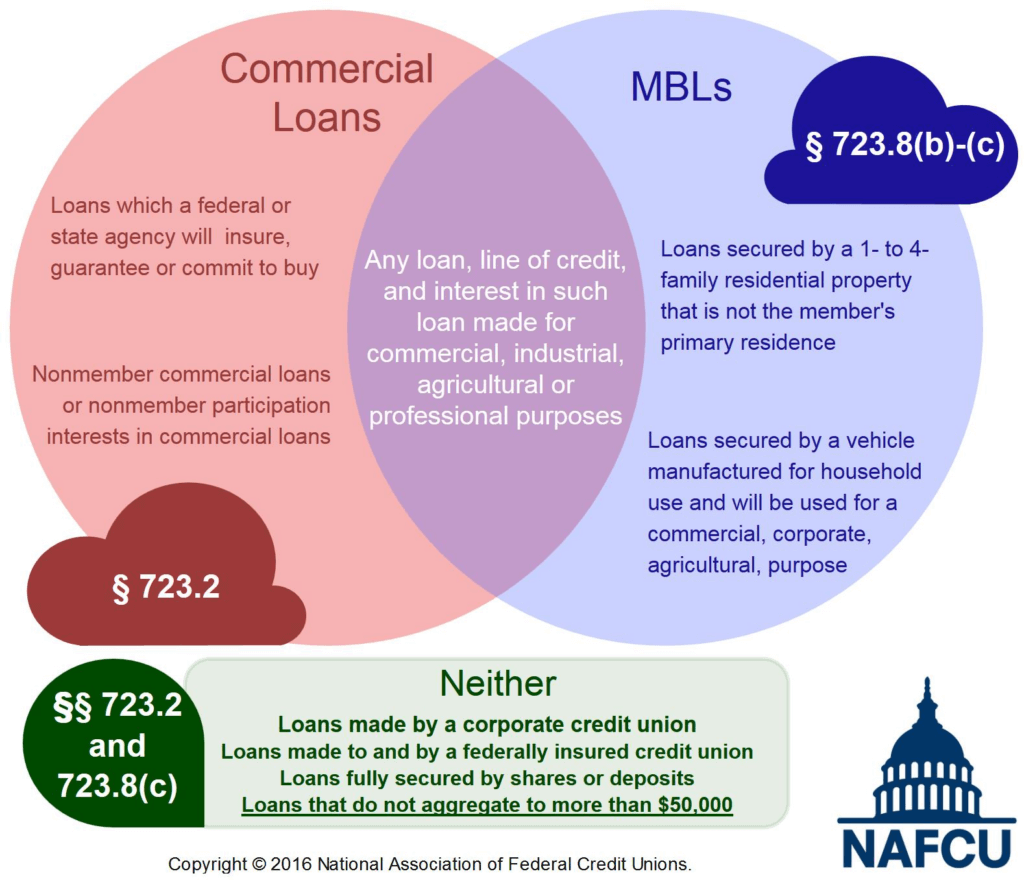

Credit unions have always been in the business of commercial lending. However, since 1998, Member Business Lending, or MBL for credit unions has been capped at 12.25 percent of a credit union’s assets. As part of larger efforts to expand credit unions’ ability to participate in commercial lending, the NCUA passed a new MBL rule effective January 1, 2017. One key aspect of the new rule is the clarified distinction between Commercial Loans and Member Business Loans, and the affirmation that “non-member loan participations do not count against the statutory MBL cap”. The below Venn diagram from NAFCU Compliance Blog outlines in broad strokes the difference between Commercial Loans and MBLs.

As credit unions begin to take advantage of their increased ability to enter the commercial lending market, they should pay special attention to the unique risks associated with different types of commercial lending. Commercial Real Estate, or CRE lending, has been identified by the OCC as an area of particular concern, with underwriting standards slipping as more financial institutions increase their investment in CRE. In a recent whitepaper, Rob Ashbaugh, a senior risk management consultant at Sageworks, walked through CRE loan origination best practices, how to build a competitive and profitable CRE portfolio, and how to best manage risk in a CRE portfolio.

Further restrictions on credit union commercial lending, such as the MBL cap, could lessen or even disappear in the coming years as organizations such as CUNA and the NAFCU advocate in Congress on the behalf of credit unions. While this represents significant new growth opportunities for credit unions, it also opens up new areas of potential risk. It will be increasingly important for credit unions to review best practices and build comprehensive strategies for credit risk management. Join the Sageworks webinar Member Business Lending: Growth and Risk Management to learn best practices for managing your MBL portfolio.