More Banks Predict Larger Impact from CECL Model

The OCC’s Thomas Curry has gone on record stating he expects a 30 to 50 percent increase in banks’ ALLL as a result of the CECL model. But how is the CECL model being perceived by banks and credit unions? What level of increase are they expecting?

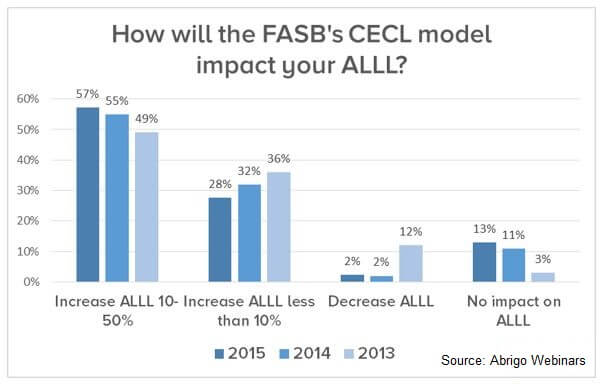

Over the past three years, Sageworks hosted a series of webinars on the FASB’s CECL model and asked attendees how the CECL model will impact their institution’s ALLL during each. The most recent poll, conducted in June 2015 during a webinar on scenario building for the ALLL, found that more bankers are expecting a 10 to 50 percent increase in their ALLL than ever before. Fifty-seven percent of respondents indicated that they expected their ALLL to increase by more than 10 percent following CECL implementation. Compared to polls conducted in February 2014 and February 2013, the percentage of bankers expecting a 10 to 50 percent increase has steadily risen, while the percentage expecting an increase of less than 10 percent has decreased. Each poll conducted had more than 250 responses.

Interestingly, the number of bankers expecting the CECL model to have no impact on their ALLL has risen substantially since 2013. Institutions that are proactively preparing for the changes are likely to see less a substantial impact, since they’ll be better equipped to defend their ALLL. Proactive preparation for CECL includes:

- Capturing, archiving and incorporating loan-level data into the ALLL

- Reducing dependency on spreadsheets

- Moving toward a more robust calculation – i.e., migration analysis

- Utilizing scenario building

Bankers interested in learning more about the FASB’s CECL model and potential impacts can access the complimentary FASB CECL Prep Kit.

For more on CECL or the ALLL in general, visit ALLL.com.