New Bill Suggests Updated Filing Thresholds for CTRs, SARs

There is a lot of chatter in today’s regulatory arena about “modernizing” regulations put in place over 30 years ago to align with today’s society and banking practices. The conversation mainly focuses around modernizing the Bank Secrecy Act (BSA) and the Community Reinvestment Act (CRA). I think we can agree both need some revamping.

H.R. 6068, the Counter Terrorism and Illicit Finance Act, was introduced to the House Financial Services Committee in June of this year. If passed, this will be a step in the right direction towards modernization. Specifically, this bill calls for increases to the Currency Transaction Report (CTR) and Suspicious Activity Report (SAR) filing thresholds.

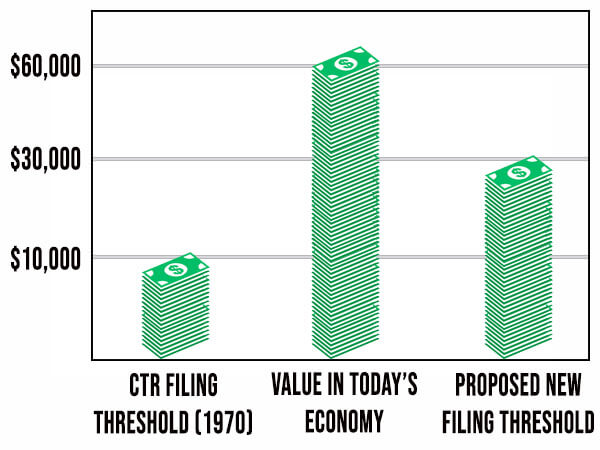

When CTRs were first introduced, $10,000 was a significant amount of money. Due to inflation, it is estimated that it equals about $66,000 in today’s economy. Do not get too excited though! The bill only calls to increase the filing threshold to $30,000.

While not aligning entirely with inflation, the new CTR filing threshold will drastically decrease the ‘paper pushing’ that does not necessarily assist law enforcement in catching the true financial criminals. I think we can easily argue SARs are better at that job! Speaking of SARs – the bill also addresses SAR thresholds. It calls for an increase in the reportable threshold from $5,000 to $10,000.

While not aligning entirely with inflation, the new CTR filing threshold will drastically decrease the ‘paper pushing’ that does not necessarily assist law enforcement in catching the true financial criminals. I think we can easily argue SARs are better at that job! Speaking of SARs – the bill also addresses SAR thresholds. It calls for an increase in the reportable threshold from $5,000 to $10,000.