Abrigo has invested in data integration and implementation processes to ensure clients maximize value from the solutions while minimizing IT resources needed from the institution.

Connecting your core to Abrigo

Core System Integration

We've invested in the process.

Quick and accurate product integration

- More than 2,000 successful integrations across 52 cores

- Guided setup process using purpose-built configuration tools

- Transparent process showing the data source and destination

- Proactive email alerts regarding integration status

- Easy to use logic (e.g., if/then) to derive and map values from multiple core system fields

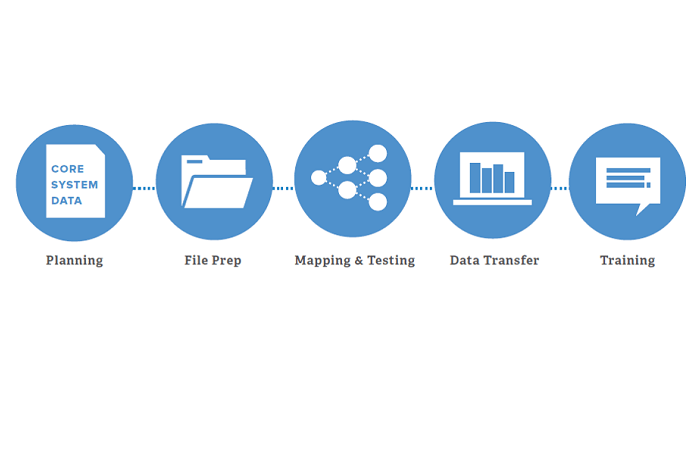

Implementation Process

Implementation will vary for each institution, depending upon the solutions being added. However, each client has a dedicated integration project manager and client success manager, who will guide implementation for a streamlined and efficient setup process.

A more detailed overview of the implementation process can be found here.

I've been banking 30+ years, and this is one of the smoothest integration processes I've ever been through.

Candace Hooten, EVP Loan Administration at People's Bank

Abrigo knows your core.

Core Intelligence for Smoother Implementation

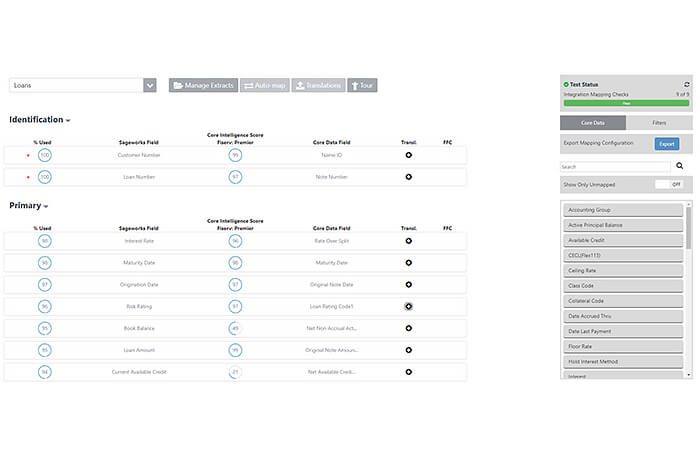

Our technology is core-agnostic and works with any core processing system that can generate reports. Abrigo uses a proprietary artificial intelligence system, Core Intelligence, which operates on a complex algorithm to help systematically match core data fields with Abrigo fields. This technology cuts down on the time required by providing recommendations when mapping data. Core Intelligence was created based on the experience of thousands of data integrations across more than 52 core systems and is a benefit unique to the integration.

Here are examples of commonly mapped fields from some of the 50+ cores we've successfully integrated.

Jack Henry: 20-20 qrybal, cbal, acctno, productcode, cbal, crleft, type

Fiserv: Premier netactiveprincipalbalance, purposecode, notenumber, productnumber

FIS: Horizon bankownedprincipalassets, callreportcode, bookbalance, accountnumber

Quickly Define Formulas

Most institutions combine core system fields to derive balance and other fields within Abrigo solutions. We make this easy and auditable using formulas and logic (e.g., if/then). Users can also define data cleansing rules that ensure information is presented meaningfully in the system.

Example functions include:

- Truncate postal codes: [Core Postal Code (Full)] = "27606-7854" → [AbrigoPostal Code] = "27606"

- Full Name Parse: [Core Name] = "John Smith" → [Abrigo First Name] = "John" & [Abrigo Last Name] = "Smith"

- Title Case Conversion: [Core Name] = "JOHNSON CONSTRUCTION LLC" → [Abrigo Name] = "Johnson Construction LLC"

- Code Translations: [Core Product Code] = "600B" → [Abrigo Product Type] = "CRE:Owner Occupied"

- One to Many Mappings: [Core Risk Rating] = "7" →

- [Abrigo Troubled Debt Restructure] = "Y"

- [Abrigo Classification] = "Individual"

- [Abrigo Watch List] = "Y"

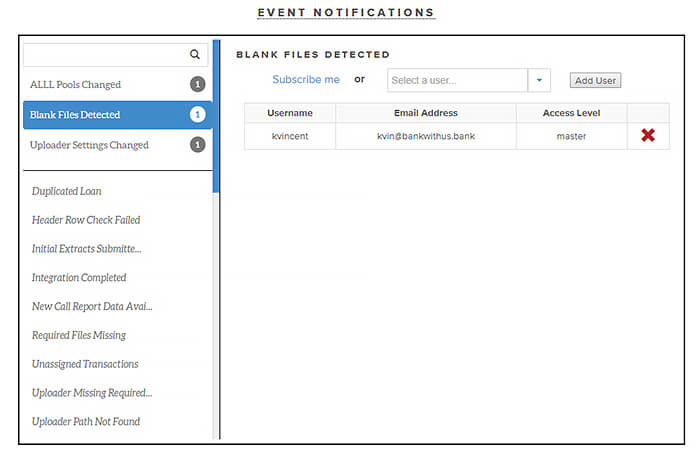

Proactive Status Updates

Abrigo uses the Event Notification Center so clients can quickly set up email notifications regarding the status of their core integration. For example, users can receive an email every time an integration is successfully completed or if there is an issue that needs attention.

With these alerts, data integrity errors can be addressed before they impact data in the institution's account (e.g., ALLL Calculations).

We’re utilizing our resources in a lot more efficient way to allow us to better digest and implement the new regulatory requirements.

DARREN FLAVELL, NATIONAL COOPERATIVE BANK

Still have some questions?

FAQ from Abrigo

How are my integration extracts transferred to Abrigo?

Clients undergoing a product implementation are able to submit rough drafts of their data extracts for review. We recommend that you work with your Integration Project Manager to leverage their expertise. Clients who have completed product implementation can set up recurring file transfers via one of two methods:

- Sageworks Uploader – The Sageworks Uploader is a small (~750KB), locally-installed program that runs by way of Windows Task Scheduler and is controlled by the institution. When it runs, the Uploader identifies integration data extracts by name and folder location. Matching files are encrypted (4096 bit RSA), transferred to Sageworks automatically via an HTTPS encrypted web connection and then deleted from the institution's server.

- Submit Files for Processing – For clients who are unable to automate local extract delivery (i.e., don't have a scheduling feature in the report writer, integrate data from multiple sources, etc.), it may be more convenient for the institution to manually submit files through the Sageworks website.

Who is responsible for designing the integration extracts?

Because the products are highly configurable and customizable, Abrigo asks that a resource at, or sourced by, the financial institution generates and designs the data extracts using the report writing programs and features available in-house/with the core. Abrigo will help the institution by way of recommended data fields, Core Intelligence Scores and the experience gained through completing hundreds of integrations across dozens of cores and other data sources.

What are the formatting requirements for integration extracts?

Our extract requirements can be found here.

What if we need extra time on the initial integration project?

Project time length is determined during the project scoping phase. Should the project require more time outside of this window, clients may opt to postpone the project and restart at a later date, understanding that the same project manager they were working with originally may not be available. If projects continue past the predetermined window, hourly charges for the additional resources required may be applicable. Client may also opt to forego the services provided by a project manager and access integration tools on their own through the Core Data Bridge.

How are post-implementation integration changes handled?

Abrigo takes pride in the integration configuration tools that have been purpose-built to make initial setup, and ongoing updates, easy and stable. Post-implementation clients have access to a product suite containing many of the same tools used by integration engineers during initial setup. This suite of tools allows authorized users to make safe changes (e.g. adding a new field mapping or code translations and more) directly in their Abrigo account. See more information on how Abrigo empowers authorized users to manage their integration configuration. Clients with more complex changes or those who prefer changes to be made by Abrigo can submit an Integration Change Request. Our team will review and work directly with those users to make, test and implement any necessary integration configuration updates.