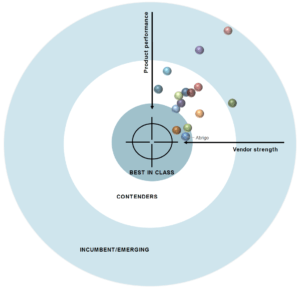

Austin, Texas, December 16, 2019 – Abrigo, the leading technology provider of compliance, credit risk, and lending solutions for financial institutions, is proud to be named a Best-In-Class vendor by Aite Group in their December 2019 Commercial Loan Origination Vendor Impact report.

Of the 16 vendors evaluated for the report, Abrigo’s technology, the Sageworks Lending and Credit Solutions, scored a Best-In-Class rating thanks to the company’s high marks in each of the four categories: vendor stability, client strength, client service, and product features. It ranked especially high in client service and product functionality.

The report from Aite Group highlights a few loan-origination advantages that Abrigo offers banks and credit unions today compared to other vendors in the report. The most notable differentiation is the company’s configurable setup, designed specifically for financial institutions’ needs. Throughout the life of the loan, the Sageworks technology boasts best practice-based templates, enabling institutions to learn from the shared experience across thousands of users and to more quickly achieve ROI with faster onboarding times.

Additionally, the report calls out the Sageworks technology’s dynamic, logic-enabled portal. As more borrowers look to engage with a bank or credit union online rather than in-branch, an institution’s online capabilities and presence will play a large role in their reputation and support of customers. Aite’s review of the Sageworks application notes the technology offers a significant amount of automation and “auto configuration” compared to other vendors. This allows borrowers to only enter the data that’s necessary, providing a streamlined, convenient experience.

The Aite Matrix also speaks to Abrigo’s extensive integrations across accounts. The technology makes it easy for loan officers and analysts to pull in information from outside sources to facilitate cross-selling and better customer service.

Source: Commercial Loan Origination, Evaluating Vendors that Hone the Tip of the Spear, Aite Group

Today, Abrigo supports more than 1,700 financial institutions in automating commercial credit analysis with the Sageworks technology and more than 850 institutions leverage the company’s LOS, making its client base one of the largest profiled in the report. Abrigo’s clients are uniquely all US-based, compared to other vendors in the report, which have a split focus between U.S. and internationally based clients.

Aite Group is an independent research and advisory firm focused on business, technology, and regulatory issues and their impact on the financial services industry. The Impact Report evaluates the overall competitive position of vendors in the commercial loan origination (CLO) space, focusing on vendor stability, client strength, product features, and client services.

Bankers interested in seeing Abrigo’s section of the Aite vendor matrix can download the report on abrigo.com or contact us at [email protected] with questions.