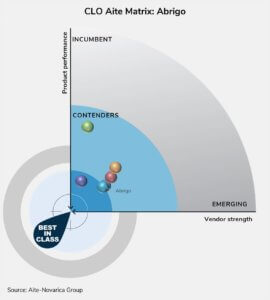

Austin, Texas, November 30, 2021 – Abrigo, the leading technology provider of compliance, credit risk, and lending solutions for financial institutions, is proud to again be recognized as a Best-In-Class vendor by Aite-Novarica Group in its November 2021 Commercial Loan Origination Automation report. Abrigo also earned the top score for client service among all loan origination system vendors evaluated.

Abrigo’s technology, the Sageworks Lending and Credit Solutions, scored a Best-in-Class rating thanks to high marks in each of four categories evaluated: vendor stability, client strength, product features, and client services. The Aite-Novarica Group evaluated seven of the largest vendors providing technology for commercial loan origination (CLO), which the advisory firm described as “one of the riskiest activities a financial institution can undertake.” Abrigo received the highest ranking for client services and ranked especially strong for product features. Low costs for implementation and ongoing service were key reasons for Abrigo’s high scores in client service, the report noted.

“In the area of product features, Abrigo led because of its acquisitive history and Sageworks’ roots in ALLL and CECL, which cumulatively give it one of the most complete product offerings among the examined vendors,” David O’Connell, Strategic Advisor at Aite-Novarica Group said. “Also boosting Abrigo’s overall score was a strong performance in client service, driven by low costs and clients’ favorable take on the perceived value of the deployment relative to its costs and the obtained features and functionality.”