Austin, Texas, October 4, 2021 – Abrigo, the leader of compliance, credit risk, and lending solutions for financial institutions, has launched an automated loan review workflow software to help financial institutions better understand and identify risk within their portfolio. Abrigo Loan Review is the latest enhancement to the Sageworks Credit Risk Solution.

Effective loan review is vital for a financial institution’s ability to meet safety and soundness standards, though it can traditionally be a time-consuming and manual process.

Effective loan review is vital for a financial institution’s ability to meet safety and soundness standards, though it can traditionally be a time-consuming and manual process.

In a recent Abrigo survey, 60% of respondents from banks and credit unions identified either staffing concerns or getting the necessary data for loan review as their biggest challenge of the loan review process.

With Abrigo Loan Review, financial institutions can overcome these challenges by streamlining the entire loan review workflow. By automating the credit risk review process, banks and credit unions gain efficiencies and eliminate labor-intensive tasks.

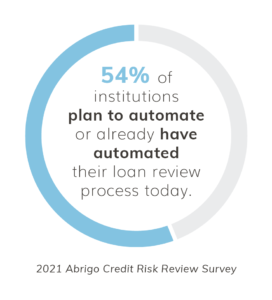

Automating the loan review process has increased in priority for financial institutions in recent years. More than half of financial institutions said that their institution plans to automate or has automated their loan review process in the Abrigo survey.