Austin, Texas, February 24, 2020 – Abrigo, the leading technology provider of compliance, credit risk, and lending solutions for community financial institutions, has released the results from its 2020 Business Lending Readiness Survey, which gauges the challenges financial institutions face related to driving loan growth and managing credit risk.

The 2020 Business Lending Readiness Survey surveyed more than 300 lenders, credit analysts, chief credit officers, and chief risk officers, as well as other professionals at banks and credit unions to understand the obstacles that stand in the way of driving loan growth, especially through rougher economic seas, as many community bankers anticipate a recession by mid-2021.

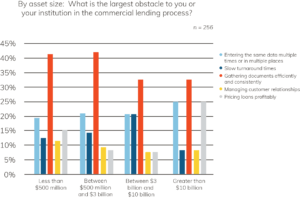

Institutions represented in the survey are dealing with processes that add costs, delay turnaround times, and lead to inconsistency in pricing and risk management. Examples include repeatedly entering the same data point into another system, managing borrower pipelines with Excel spreadsheets, and using manual data entry to create credit memos. Nearly a third of respondents reported that it takes five to seven weeks at their institution to close a commercial loan.

“Standardizing inconsistent processes is an easy win for productivity,” said Alison Trapp, Director of Client Education at Abrigo, in the survey report. Manual processes and inconsistencies affect not only institutions' loan turnaround time, but also their ability to price loans accurately and assign risk.

Only one in five institutions currently offers an online loan application. Despite how lengthy and complex manually creating credit memos can be, only 10% of surveyed institutions are using an automated solution.

“Institutions should be looking for a system with a single point of data entry to save as much time as possible so their employees can focus on working with customers and generating more deals, or analyzing loans and creating narratives in credit presentations rather than entering the same customer name and address 11 times,” said Abrigo Credit Consultant John Millman.