Asset/liability management is a crucial process designed to maximize an institution’s profitability while managing risk. The broad goal of ALM is to help produce sustainable earnings without compromising other interests of the institution. This infographic breaks down the goal of ALM into three key objectives.

Download to Learn:

- Key profitability outputs ALM measures

- Measured metrics that drive profitability

- Types of risk to consider

- Regulatory expectations

This resource is part of the series ALM 101: Introduction to Asset/Liability Management.

Alignment of critical assumptions and inputs across stress testing, asset/liability management (ALM), and the calculation of expected credit losses is fundamental to a holistic view of risk management. In addition, institutions that identify and manage risk most effectively will outperform their peers in terms of financial performance while also maintaining safety and soundness. In this infographic, learn four ways financial institutions should ensure their allowance for credit losses models under CECL are aligned with the risk management processes of stress testing and ALM.

Time is quickly ticking down for financial institutions adopting the current expected credit loss, or CECL, accounting standard in 2023. As these banks and credit unions work to identify and gather relevant loan-level data and select a methodology for calculating the allowance for credit losses, or ACL, they must also deal with coronavirus-related operational challenges, such as increased loan modifications and credit losses, a surge in fraud attempts, and myriad staffing issues related to the pandemic. Understanding some of the myths and misconceptions about implementing CECL will help these financial institutions avoid some of the hazards to navigating the change.

Download to learn:

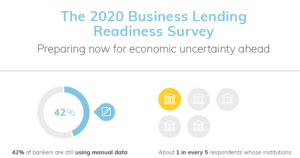

- Pain-points discovered within the lending and credit process at financial institutions

- Portfolio strategies of institutions in the coming year

Processes such as handling new loan requests, risk rating, and performing due diligence are all a part of a larger process: the life of a loan.

Loan origination can be a long, frustrating process that requires large spreadsheets, data to be re-entered multiple times, and constant document collection.

By turning to automation, lending and credit professionals can focus more on revenue-generating and customer-facing activities instead of duplicative data entry and tracking down components of an application.

See the step-by-step benefits and stark difference between an automated and manual lending process, and learn how automation can help your financial institution today.