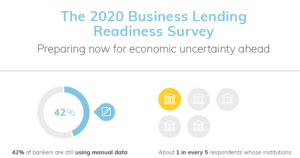

Download to learn:

- Pain-points discovered within the lending and credit process at financial institutions

- Portfolio strategies of institutions in the coming year

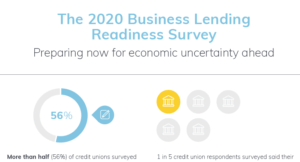

Download to learn:

- Pain-points discovered within the lending and credit process at credit unions

- Portfolio strategies of credit unions in the coming year

Processes such as handling new loan requests, risk rating, and performing due diligence are all a part of a larger process: the life of a loan.

Loan origination can be a long, frustrating process that requires large spreadsheets, data to be re-entered multiple times, and constant document collection.

By turning to automation, lending and credit professionals can focus more on revenue-generating and customer-facing activities instead of duplicative data entry and tracking down components of an application.

See the step-by-step benefits and stark difference between an automated and manual lending process, and learn how automation can help your financial institution today.

The CECL transition is one of the biggest changes to bank accounting ever. Many financial institutions are making progress towards the transition, while some are falling further behind.

Download this complimentary infographic to learn:

- What tools financial institutions are using for CECL

- The expected impact on resources, staff, and compliance

- Which specific methodologies financial institutions are considering