Savvy banks and credit unions are looking to digital applications to help customers and members secure funds faster and improve the borrower experience. With Sageworks Dynamic Application and our loan origination system, financial institutions can increase staff efficiency and allow borrowers to complete applications at their convenience.

Commercial Lending Software

- Loan Application

- Loan Decisioning

- Relationship Manager

- Workflow

- Document Management

- Analytics and Reporting

- Special Assets Management

- Commercial Account Opening

Subscribe to our Newsletter

SubscribeKeep Me Informed

Stay up-to-date on industry knowledge and solutions from Abrigo.

Create Scalable Growth Through Your Digital Branch

Dynamic Application

Sageworks Dynamic Application Software

Deliver a modern & efficient application experience.

Expedite Turnaround

To be competitive and foster growth, financial institutions must get back to customers quickly by streamlining the application process and scaling efficiently. Sageworks Dynamic Application allows you to offer modern, easy-to-complete applications tailored to your busy customers.

Play Video

Features and Functionality of Dynamic Application

Modern, convenient application for faster loan turnaround and heightened customer satisfaction.

Efficient Workflows

Eliminate bottlenecks for staff and streamline document collection and communications with borrowers.

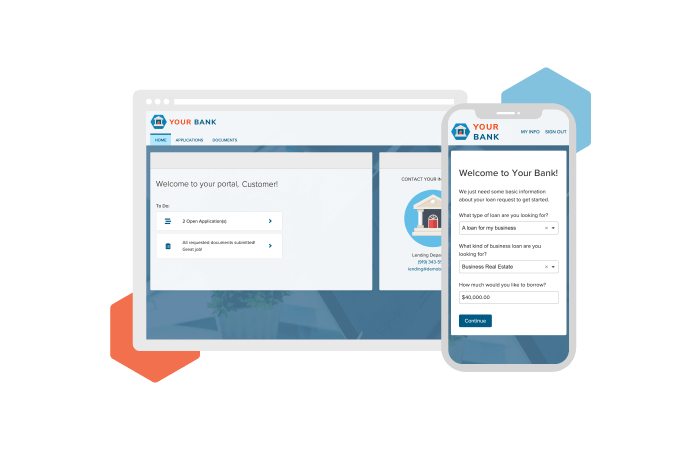

Sleek, Digital Design

Provide a modern, mobile-first customer experience optimized for applicants on-the-go.

Cost-effective Origination

Lower administrative costs of originating a loan as customers submit data and documents directly.

Customized Templates

Add and customize templates for various application types, including business, personal, SBA, and nonprofit.

Improved Transparency

Enable applicants to easily access the portal for updates and additional information on their applications.

Responsive Applications

Applications can trigger fields and field assets based on an applicant’s answers to questions.

Better Customer Experience

“Our customers have been pleased with the ease of the online application process as have our lenders, who would not have been able to process as many applications had they been working with a paper-based application and documentation process.”

Glenda Sorotski, EVP, Chief Credit Officer, Western States Bank

Advantages of Sageworks Dynamic Application

Increase the speed of decisioning through loan automation software.

Drive new business with loan application software that's integrated with the bank’s loan origination process. Prospects enter information once, while current borrower information can be pulled in automatically. Coupled with enhanced workflows and automation on the back end, institutions can turn around applications quickly.

-

![]()

Submit Application

Reduce back and forth and document chasing with an online experience.

-

![]()

Decision Loan

Use conditional logic to make faster decisions that align with institution policies.

-

![]()

Digital Signature Capabilities

Easily send, track, and collect e-signatures from borrowers for loan documents, eradicating barriers in the origination process.

-

![]()

Complete Origination

Finalize and verify documentation needed to close the loan using automated workflows.

Efficient and Digital Friendly Processes

"Like other banks, we were looking for ways to grow the loan portfolio, and to do that we needed a process that’s both scalable and customer-centric. With Sageworks Loan Application we can meet those objectives, reduce inefficient back and forth communication, eliminate manual steps for our lenders, and expedite the process so we get back to borrowers more quickly."

Eric Bergevin, President & CEO, West Town Bank & Trust