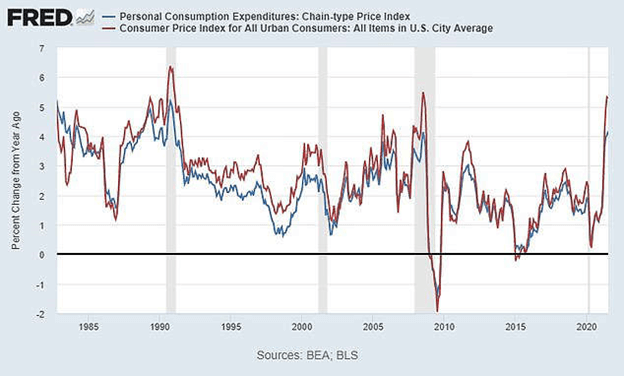

Looking for information on growing your bank or credit union while the Fed is raising interest rates? See this newer post, "Growth in a rising-rate environment."The FOMC is charged with the difficult task of maximizing employment while holding consumer prices steady with targeted inflation under 2% annually. While low interest rates can spur strong economic growth and keep investors happy, financial institutions are typically more profitable with a steeper yield curve when overall interest rates are higher. If the pandemic has taught us nothing else, it is that “typical” does not fit well in our vocabulary and that economic recovery is not a straight pathway.

Asset/Liability

Deposit Pricing Optimization

Deposit Pricing Strategy

Lending & Credit Risk

Loan Origination System

Loan Pricing

Member Business Lending

Portfolio Risk & CECL

Waiting (patiently?) for interest rates to rise: 4 growth moves to prepare for Fed rate hike

October 21, 2021

0 min read

About the Author