Slow lending decisions and frustrating loan application processes are among borrowers’ biggest gripes with traditional financial institutions vs competitors such as online or alternative lenders. Ask the staff of banks and credit unions about the loan application, underwriting, and onboarding processes at their respective institutions, and you’ll likely hear some complaints from them, too.

When commercial bankers making $200,000 a year are driving all over town to pick up supporting documents just to get the completed loan application moving forward instead of calling on prospects, inefficiencies of a manual application system are personally frustrating. When commercial credit analysts earning $25 or more an hour are performing data entry for every tax return of a business entity tied to a loan application, the underwriting process is taking too long and requiring too many hours of labor by skilled workers for repetitive tasks.

When commercial bankers making $200,000 a year are driving all over town to pick up supporting documents just to get the completed loan application moving forward instead of calling on prospects, inefficiencies of a manual application system are personally frustrating. When commercial credit analysts earning $25 or more an hour are performing data entry for every tax return of a business entity tied to a loan application, the underwriting process is taking too long and requiring too many hours of labor by skilled workers for repetitive tasks.

“Automating the entire life of a loan – from application, through credit analysis, decisioning, onboarding, and beyond to annual reviews or even loan renewals – can save financial institutions substantial labor hours,” says Abrigo Vice President of Banking Neill LeCorgne. “It’s a generational opportunity to enhance earnings. That’s what 99% of bankers are trying to do. You’re always trying to enhance earnings.”

LeCorgne, the former president of multi-bank holding company who, before that, managed a corporate banking team at a super-regional bank, says technology can transform the business lending process from one that consumes 35 labor hours at a cost of $2,422 to one that takes 16 hours at a cost of just over $1,000. He estimates that a technology lending solution can shorten renewals of small business loans to a process that takes just over 3 hours at a cost of about $300. Typically, financial institutions send loan renewals along an underwriting process that parallels that of a new loan – a highly inefficient path that is also frustrating for the customer, he notes. The time and labor savings leave lenders more time to develop their pipelines and provide credit analysts more time to focus on complex deals – without hiring additional staff.

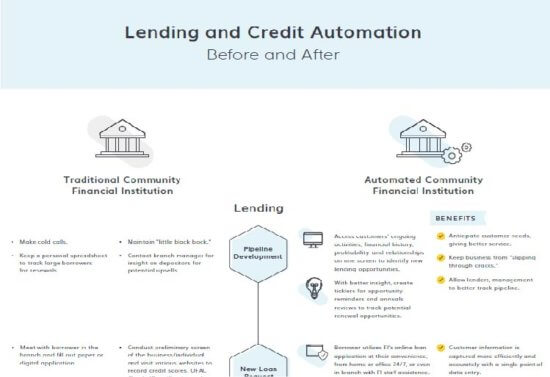

Where do the time savings come from when a financial institution switches from manual lending and credit processes to systems leveraging automation? A look at the steps of an institution relying on manual processes and an institution utilizing technology sheds light.

Origination

During pipeline development at a traditional bank or credit union, lenders will maintain a “little black book” of prospects and track large borrowers for renewals using a personal spreadsheet. Contacting a branch manager might yield insight on depositors for potential upsells for loans. Automated financial institutions utilizing a relationship manager solution have access to customers’ ongoing financial activities and history, profitability and relationships, providing them immediate insight into lending opportunities. They also have the ability to create ticklers to remind them of opportunities to help keep business from slipping through the cracks.

A bank or credit union utilizing an online loan application can provide borrowers the option of filling out the form at their convenience, from home or their office around the clock. Alternatively, the institution can offer to help the prospect fill out the online application in the branch or over the telephone. Either way, current customer information is automatically pulled into the form and borrowers are prompted for the required forms, which they upload through a secure, online portal. The document manager system captures applicant information more efficiently and accurately than when staff must key in data from paper applications. This reduces bottlenecks and is easier for borrowers and lenders. Importantly, the borrower can upload financial statements and tax returns from home or the office. Not only does this reduce manual data entry, it also allows borrowers to avoid going to a branch if they want to do so, and it simplifies the document-gathering process for lenders, satisfying the goal of ending those around-town trips seeking out documents. Loan officers and administrative teams across locations have real-time visibility into the status of documentation without having to track them on spreadsheets, and they can build out templates for quick reports, such as a loan proposal, term sheet, commitment letter, etc., throughout the loan process.

A bank or credit union utilizing an online loan application can provide borrowers the option of filling out the form at their convenience, from home or their office around the clock. Alternatively, the institution can offer to help the prospect fill out the online application in the branch or over the telephone. Either way, current customer information is automatically pulled into the form and borrowers are prompted for the required forms, which they upload through a secure, online portal. The document manager system captures applicant information more efficiently and accurately than when staff must key in data from paper applications. This reduces bottlenecks and is easier for borrowers and lenders. Importantly, the borrower can upload financial statements and tax returns from home or the office. Not only does this reduce manual data entry, it also allows borrowers to avoid going to a branch if they want to do so, and it simplifies the document-gathering process for lenders, satisfying the goal of ending those around-town trips seeking out documents. Loan officers and administrative teams across locations have real-time visibility into the status of documentation without having to track them on spreadsheets, and they can build out templates for quick reports, such as a loan proposal, term sheet, commitment letter, etc., throughout the loan process.