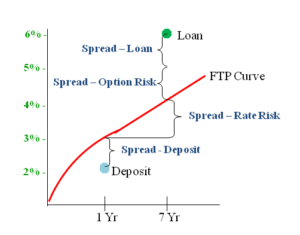

We all know that an institution earns income primarily from the interest spread between earning assets (loans) and deposits. The LoanEDGE pricing model calculates loan income by considering loan interest and fees. But it does not calculate loan expense (funding expense) by using your cost of deposits. We use funds transfer pricing methodology (FTP) to calculate the cost of the funding that supports a loan. The cost is calculated by balance weighting the rates from the wholesale funding curve attached to your accounts using the principal balances necessary to support the loan. FTP theory is based on the recognition that both lending and deposit gathering activities are economically valuable to an institution. We trust that lending is valuable because it usually earns a yield above our cost of the related funding. We know deposit gathering is valuable because funds can be acquired at rates less than what we would have to pay in a wholesale market by borrowing the funds. Deposits are also valuable because non maturity deposit actual durations are longer than the contractual duration and they also tend to have lower pricing responses to market rate increases. FTP measures the independent contributions of loans versus deposits by comparing each to an independent wholesale cost of funds. We typically use an FHLB borrowing rate curve for the district in which an institution is located as the best available wholesale rate curve. But it is possible, if appropriate, to use other rates such as a brokered CD market curve, a swap curve, or a corporate bond curve. By using an independent funding curve we can measure the spread between the deposit cost and the curve, then between the curve and the loan income. Because durations of loans and deposits will vary, the FTP method also helps us assess the inherent interest rate risk and option risk reflected by a curve comparison. The following graphic illustrates four separate spread components that FTP methodology attempts to measure.