As Robert Frost observed, “education is hanging around until you’ve caught on.” But if you’re the new kid on the block, you haven’t been there long enough to catch on. So, the conundrum is that loan reviewers are expected to meet some minimum combination of education, experience, and training. They should be knowledgeable of both sound lending practices and their own institution’s specific lending guidelines. In addition, they should be familiar with pertinent laws and regulations affecting credit and lending activities. But what if the minimum expectations are set so high that it discourages wannabe loan reviewers?

There is a well-documented shortage of junior reviewers, which means loan review units need to recruit people short on education, training, and experience. Meanwhile, more senior staff are generally not getting their fair share of intermediate and remedial loan reviewer training. These challenges call for the development and implementation of some minimum but reasonable standard of education and training, so let’s put some suggestions on the table.

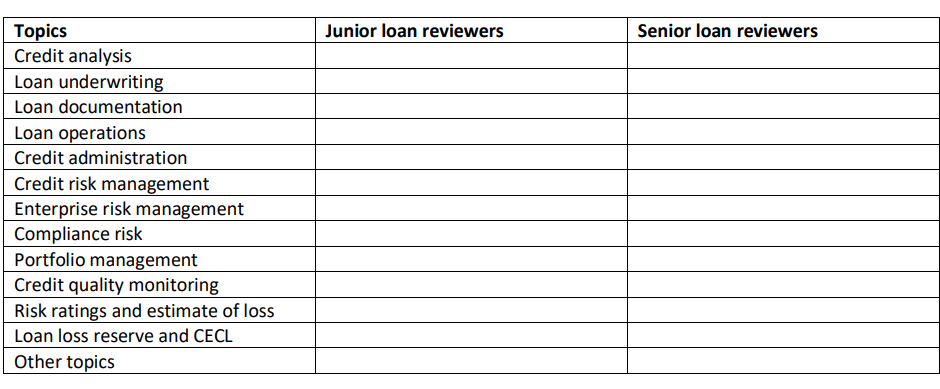

Junior loan reviewers ought to have basic credit and lending expertise, including:

- Credit analysis including evaluation of cash flow, collateral, and guarantors

- Underwriting basics such as minimum debt service coverage ratios, maximum collateral loan-to-value ratios,

guarantor strength, evaluation of financial statement projections, maximum loan terms, and amortization - Commercial and commercial real estate loan documentation

- Commercial loan operations for loan doc preparation, loan doc closing, booking, and funding

- Basic compliance concepts such as spousal guarantees and real estate-related requirements

Relevant prior experiences would be as credit analysts, lending assistants, and/or any role in supporting business lenders in client support, prospecting, and credit requests for new and existing borrowers. These experiences help candidates understand the dynamics of commercial relationships and the interplay between lenders and the credit approval process. Some banks have enough critical mass to rotate junior teammates from credit analysis to workout to loan review for 6-month exposures to each of these areas before sending them on to lending assignments. The rotation assures them that they are not permanently assigned to any of these areas, but the exposure is long enough to give them some basic proficiencies. Yet another educational focus should include some basic statistics in valid sampling techniques to understand how loan review frequency, scope, and depth interplay.

Besides basic compliance requirements for business borrowers such as appraisal requirements, junior reviewers also need to be aware of accounting issues affecting borrowers—revenue recognition, lease capitalization, current expected credit loss, and troubled debt restructuring. Generally accepted accounting principles change over time, and regulations get revised, so loan reviewers need to be cognizant that accounting rules and regulatory rules are not engraved on stone tablets but are prone to change, too.

This is certainly not an exhaustive, complete list, but it is meant to get readers thinking about what you would revise, add, or delete from the list to move one step closer to actually implementing some basic curriculum. Keep in mind that the junior reviewer pool has been shallow because banks have generally preferred to recruit more experienced loan reviewers from other banks rather than try to build a junior layer to give senior loan reviewers more time to work on more challenging credit exposures.

A short list of training topics for senior loan reviewers might include:

- Credit risk management and its role among the other enterprise risks

- Merger and acquisition accounting given loan review’s frequent deployment on due diligence teams

- Basic forensic accounting techniques to identify fraud

- Current expected credit loss processes and loan loss reserve calculations, including the role of the risk rating

systems in estimating loss via obligor probability of default and transactional loss given default - More advanced compliance issues and regulatory guidance