This post was updated to reflect new compliance deadlines announced by the CFPB on June 25, 2024.

Lending & Credit Risk

C&I Loans

Commercial Lending

Construction Lending

CRE Lending

Lending Regulation

Loan Origination System

Member Business Lending

Small Business Lending

CFPB 1071 Compliance: What you need to know

July 2, 2024

Read Time: 0 min

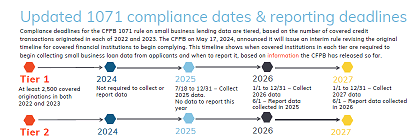

New timelines for small business loan data collection and reporting

The Consumer Financial Protection Bureau (CFPB) 1071 rule was effective in 2023, but section 1071 compliance dates will be extended following a Supreme Court ruling, according to the CFPB. The 1071 compliance dates are for collecting and reporting data on small business loan activities.

You might also like this one-page summary of key dates and deadlines for complying with the 1071 rule.

Takeaway 1

The effective date of the CFPB's new rule based on Section 1071 of the Dodd-Frank Act was August, 29, 2023. But compliance dates and deadlines are tiered.

Takeaway 2

The reporting tiers and compliance deadlines for CFPB 1071 are based on the number of covered transactions a lender originated in 2022 and 2023 or in 2023 and 2024.

Takeaway 3

As modified by the CFPB in June 2024, the earliest deadline to begin collecting data is July 18, 2025. The earliest for reporting initial data is June 1, 2026.

Final rule

Effective dates & compliance dates for rule 1071

As they do with any new requirement, financial institutions want to know when the CFPB 1071 rule is effective and when they must begin collecting and reporting data on their small business lending activities.

The effective date of the Consumer Financial Protection Bureau’s (CFPB) new rule was August 29, 2023. However, compliance deadlines and related deadlines for reporting the data collected about small business loan applications are tiered. This staggering of compliance deadlines requires the small business lenders originating the most transactions to begin reporting data earlier than less active small business lenders.

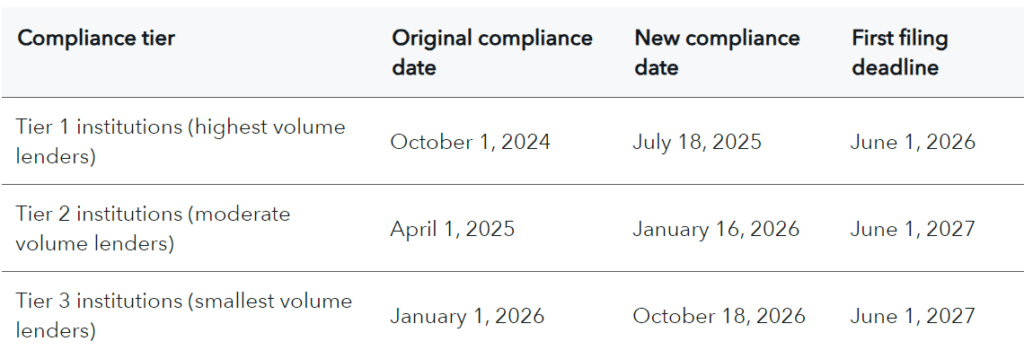

A Texas judge had stayed compliance deadlines pending a Supreme Court ruling over the constitutionality of CFPB funding. Following the Supreme Court's decision in favor of the CFPB on that issue, however, the agency extended the 1071 rule’s compliance deadlines. The CFPB issued an interim final rule outlining the new 1071 compliance dates and filing deadlines as follows:

Source: CFPB

How to stay ahead of compliance

Despite the seemingly long runway to prepare, it's not too early to get a handle on the new requirements and how they will affect a bank or credit union. With the changes, many financial institutions face the most significant data collection and reporting effort in nearly 50 years. Given this scope, lenders need to begin assessing now how and when they will comply.

Abrigo has helped hundreds of bank and credit union staff members learn more about 1071 and how to prepare for it. Webinars, podcasts, and whitepapers provide tips for capturing small business loan data, storing it, and reporting it to the CFPB to comply with the required timelines. In addition, Abrigo's small business loan origination software can automate 1071 data collection and reporting.

Below are details on important dates for 1071 compliance, which financial institutions must comply, and what the changes involve.

Which FIs must comply

What are the goals of 1071?

Before discussing 1071 compliance dates, it’s helpful to understand the rule’s goals and which financial institutions it affects.

The final rule implements section 1071 of the Dodd-Frank Act by amending the Equal Credit Opportunity Act (ECOA), or Regulation B (Reg B). The CFPB small business lending data collection regulations are being included as subpart B of Reg B and aim to support and enforce the fair lending requirements. CFPB intends the data collected by lenders on each small business credit application to shed light on potential disparate treatment in loan terms, especially related to minority-owned small business applicants, including women-owned small businesses. Reporting on the data is also expected to help identify small business owners’ needs and credit opportunities. A CFPB compliance aid lists 81 data fields for information lenders must collect and report.

Which lenders are counted as “covered financial institutions” in the 1071 rule?

The rule outlines that any company or organization engaged in lending activities is covered.

Would you like to stay up to date on CFPB 1071 implementation?

This means that in addition to banks and credit unions, other lenders subject to the rule’s mandates are finance companies, online lenders, Community Development Financial Institutions (CDFIs), government lenders, and nonprofit lenders.

Tiers determined by transaction volume

Earliest deadline is 2024

Three deadlines for CFPB 1071 rule compliance

The earliest reporters are those that have originated at least 2,500 small business loans covered by the rule in 2022 and at least 2,500 in 2023. These financial institutions must begin data collection in July 2025 and continue through the end of the year, based on the CFPB's announced updated timeline. The data collected needs to be reported by June 1, 2026. For following years, lenders must collect data for the full year and report it by the following June 1.

The second tier of deadlines covers financial institutions with at least 500 covered originations each year during 2022 and 2023. This group of small business lenders must begin collecting data on Jan. 16, 2026, and they must report data collected for the entire 2026 year by June 1, 2027.

The last group of lenders required to collect and report data on small business loan applications is financial institutions with at least 100 covered originations each year during 2022 and 2023. These banks, credit unions, and other lenders have to begin collecting data on Oct. 18, 2026, and they are required to report the 2026 data by June 1, 2027.

The CFPB has produced an info sheet with more details and examples of when financial institutions must begin collecting data and complying with the small business lending rule.

In this document, the bureau notes that if an institution determines it’s not required to comply with the rule in 2025 or 2026, it must nevertheless determine in subsequent years whether it must, based on whether it originates at least 100 covered originations in each of the two calendar years immediately preceding the year in question. The document was written before the Supreme Court ruling that prompted the extension of the compliance dates for 1071, so it's likely to be updated.

Each reporting tier and its associated deadline is determined by the number of covered transactions to small businesses that a lender originated in each of 2022 and 2023. The CFPB's latest update to the rule added that lenders could also use the number of covered originations in 2023 and 2014 to determine their deadlines.

In fact, a company or organization must have originated at least 100 covered credit transactions in 2022 and 100 in 2023 (or 100 in 2023 and 100 in 2024) to be subject to the rule’s requirements (i.e., be considered a “covered financial institution”).

What is a covered transaction

The CFPB generally describes it as a request for any of the following:

- Loans

- Lines of credit

- Credit cards

- Merchant cash advances

- Credit products used for agricultural purposes

Requests for additional credit on an existing loan are not counted as originations for the purpose of determining a covered financial institution.

Defining "application" for a covered transaction

For data collection and reporting, financial institutions must track applications they receive for covered transactions, as opposed to solely tracking originations. What is an application under the CFPB 1071 rule? It is an oral or written request for a covered credit transaction that is made following the procedures used by a financial institution for the type of credit requested. This means that lenders must track data not only related to approved and booked credit but also applications that are any of the following:

- Withdrawn

- Incomplete

- Denied

- Approved by the lender but not accepted by the applicant

A re-evaluation, extension, or renewal request on an existing business account is excluded from the definition of covered applications as long as the request seeks no additional credit. Inquiries and prequalification requests are also excluded.

How a lender defines an application as incomplete or withdrawn can vary from financial institution to institution, noted Abrigo Senior Advisor Paula King, CPA, who is already working with financial institutions to plan for and prepare 1071 reporting.

The CFPB “has left it up to financial institutions as to where you feel the cutoff is for an incomplete application” or a withdrawn application, she said. Regardless of how the bank or credit union defines these application resolutions, the lender should spell it out in the loan policy, King added. Loan policies should also clarify how a counteroffer by the lender will be treated.

Which credit transactions are excluded from 1071?

Several types of transactions are excluded from the CFPB’s requirements to report on applications. Among those considered excluded transactions:

- Letters of credit

- Trade credit (i.e., financing arrangements such as accounts receivable with a business providing goods or services)

- Public utilities credit

- Securities credit

- Incidental credit defined in Regulation B as exempt (e.g., not payable in more than four installments; not subject to finance charge)

- Factoring

- Leases

- Consumer-designated credit used for business/ag purposes, such as taking out a home equity line of credit or charging business expenses on their personal credit cards

- Purchases of originated covered credit transactions

- Applications with potential HMDA and section 1071 overlap: CFPB does not require reporting under section 1071 (transactions would only be reportable under HMDA)

A final component of the rule that is useful in understanding the various deadlines for 1071 reporting is the CFPB’s description of what constitutes a small business. An applicant or borrower is considered a small business if it is a business (including agricultural) that had $5 million or less in gross annual revenue for its preceding fiscal year before applying.

Three deadlines for CFPB 1071 rule compliance

The earliest reporters are those that have originated at least 2,500 small business loans covered by the rule in 2022 and at least 2,500 in 2023. These financial institutions must begin data collection in July 2025 and continue through the end of the year, based on the CFPB's announced updated timeline. The data collected needs to be reported by June 1, 2026. For following years, lenders must collect data for the full year and report it by the following June 1.

The second tier of deadlines covers financial institutions with at least 500 covered originations each year during 2022 and 2023. This group of small business lenders must begin collecting data on Jan. 16, 2026, and they must report data collected for the entire 2026 year by June 1, 2027.

The last group of lenders required to collect and report data on small business loan applications is financial institutions with at least 100 covered originations each year during 2022 and 2023. These banks, credit unions, and other lenders have to begin collecting data on Oct. 18, 2026, and they are required to report the 2026 data by June 1, 2027.

The CFPB has produced an info sheet with more details and examples of when financial institutions must begin collecting data and complying with the small business lending rule.

In this document, the bureau notes that if an institution determines it’s not required to comply with the rule in 2025 or 2026, it must nevertheless determine in subsequent years whether it must, based on whether it originates at least 100 covered originations in each of the two calendar years immediately preceding the year in question. The document was written before the Supreme Court ruling that prompted the extension of the compliance dates for 1071, so it's likely to be updated.

We can help you navigate 1071 deadlines and compliance. In addition to our 1071 resource page for lenders, which has updated information to help prepare for the new requirements, Abrigo’s Loan Origination Software will have all required data fields in a borrower-facing collection form, access to pre-built reports, and the ability to export for CFPB reporting. Your financial institution can comply with 1071 while streamlining the origination process and ongoing customer management while working with a trusted partner of 2,400 institutions. Talk to a specialist to learn more.

You might also like this checklist to help prepare for implementing the 1071 rule: "CFPB 1071 rule: Checklist for compliance success."

Download

About the Author