After performing its annual loan review survey, DiCOM, now Abrigo, references the results against other industry touchpoints to create a holistic view of key trends and issues facing loan review. The 2021 review revealed several actionable trends in barriers that are holding back many loan review organizations. The good news is these challenges can be largely mitigated by using loan review software like Credit Quality Solution (CQS). The following are the most common problems identified--and the most solvable.

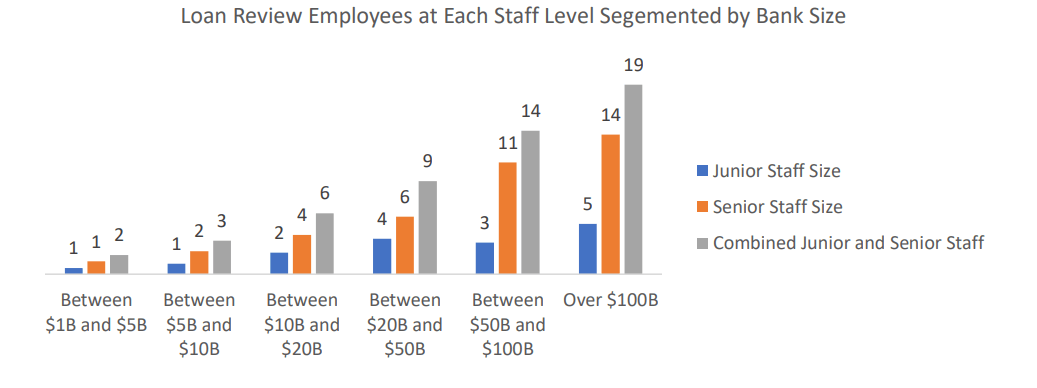

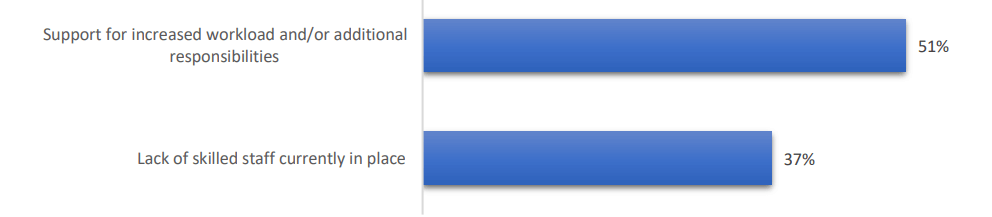

- Difficulty hiring and onboarding new loan review staff

- Remote work environments make collaboration more difficult

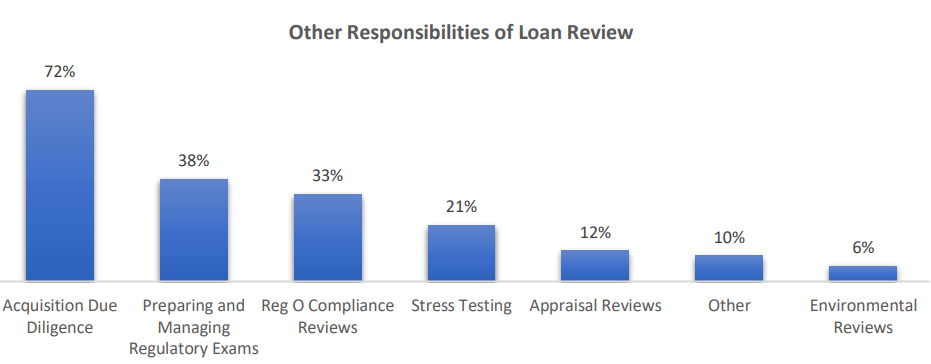

- Additional responsibilities such as acquisition due diligence assigned to loan review teams