Overall interest rate risk exposures show a stronger positive correlation to rising rate shocks. Median increases in net interest income (earnings at risk) over a 12-month period for a 2% rate shock rose from +3% in 2019 to +7% in 2021. This would make sense given the high levels of liquidity still in the banking system being invested in short-term instruments.

Overall Economic Value of Equity (EVE) moved from slightly liability sensitive with a -1% decline in the +2% shocks in 2019 to a +2% level in 2021. Much of these results are dependent upon the non-maturity deposit assumptions applied to changing rates.

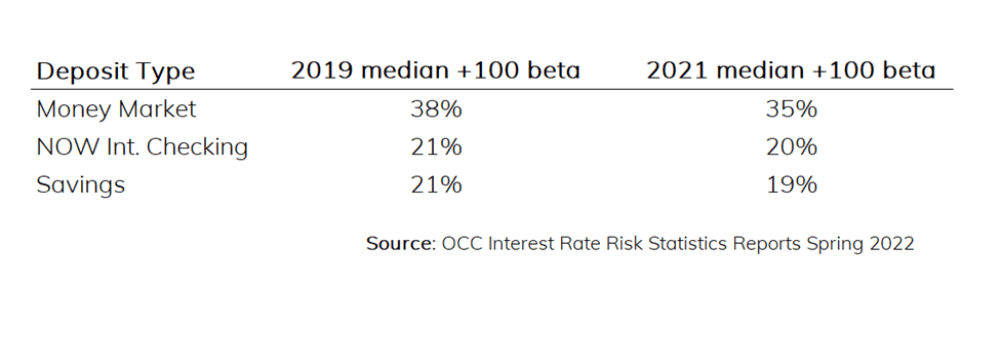

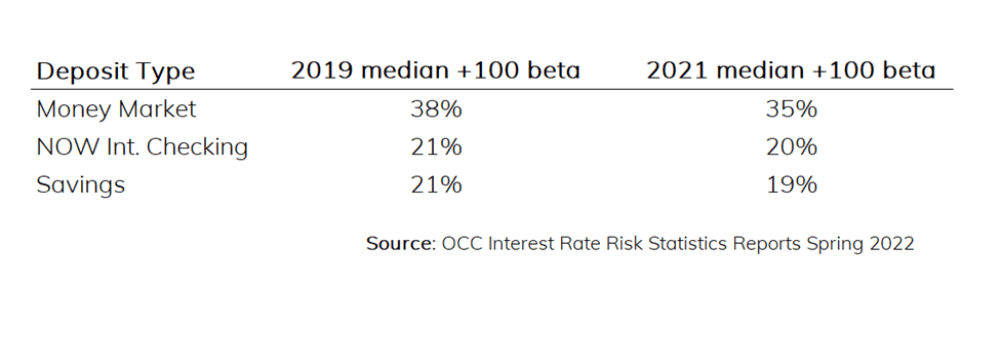

In 2019, median deposit betas (the amount or rate increased applied to deposit prices) were reported at lower levels in the 2021 survey vs. the 2019 survey (see chart).

This decline in deposit beta is troubling and may misrepresent earnings at risk as so much of the increased liquidity is sitting in these non-maturity deposit accounts. And while the actual account rates may not move significantly as the Fed raises rates, without a doubt, depositors will shift between different offerings, or there will be promotional pricing that is used to retain funds that will result in a higher cost of funds than the simple “account level” beta. Be sure to be testing out how different surge balance cost assumptions impact your overall margin in the coming 2 years.

The result of lower deposit betas is a longer implied average life of the deposit accounts. Each sector saw slightly longer average lives than in 2019, meaning that the institutions generally think they can avoid paying up as rates rise, and monies will remain on deposit longer. If this is a bet being used to support asset duration extension, careful modeling of stressed assumptions is recommended to ensure stable margins.

When we break down these assumptions by asset size there are some general observations that hold true. Smaller institutions model the deposit beta and average life assumptions with more longevity than the larger institutions. Larger institutions err on the side of higher costs and shorter lives as a measure of potential risk exposure.

Lastly, the report presents policy limits for both earnings- and value-at-risk. Overall, median policy limit levels level for earnings-at-risk limits have widened slightly since 2019 while general EVE limits have remained the same.

As noted earlier, comparing your internal model values to these statistics can be helpful as sort of a

“temperature check” against what regulators have been seeing. Asset/liability management advisors with decades of industry experience can assess how your financial institution’s results compare to the OCC data. They can also provide perspective on how an updated core deposit study can bring about more actionable data like demographics, surge estimates, etc., specific to your institution that will help you plan for moves to remain competitive and profitable.