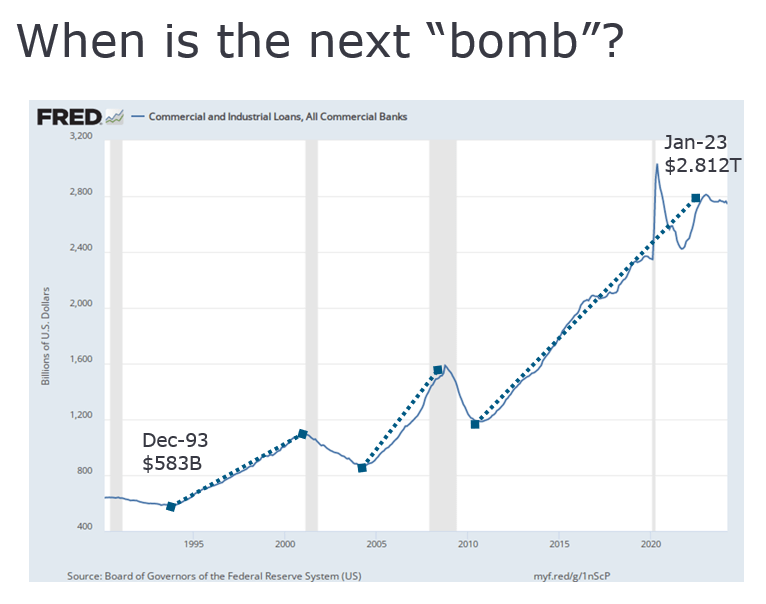

If opportunities to drive bank or credit union performance are like the waves surfers seek constantly, C&I lending will be the next “bomb,” according to Joel Pruis, Senior Director and Lending & Operations Practice Lead at Cornerstone Advisors.

In surfing, a bomb is an especially large or heavy wave, and Pruis believes C&I lending can be the next big performance driver for financial institutions. During Abrigo’s recent ThinkBIG conference, Pruis encouraged lenders to overcome current obstacles to growing their C&I portfolios to gain their share of what could be a $1.7 trillion surge in new C&I balances during the next economic expansion.

Pruis outlined:

- What’s at stake for lenders

- Common obstacles to sound C&I lending performance

- Steps that will enable institutions to boost financial performance by “shredding” the upcoming business lending wave.