Given these obstacles to profitability, here are four moves financial institutions should make to still take advantage of opportunities available to generate growth in this rising-rate environment.

Take steps to ensure strategic pricing on both sides of the balance sheet.

Take steps to ensure strategic pricing on both sides of the balance sheet.

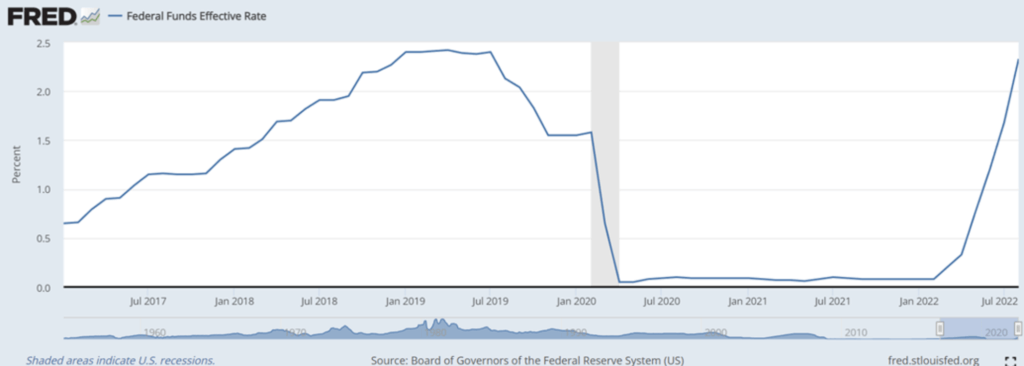

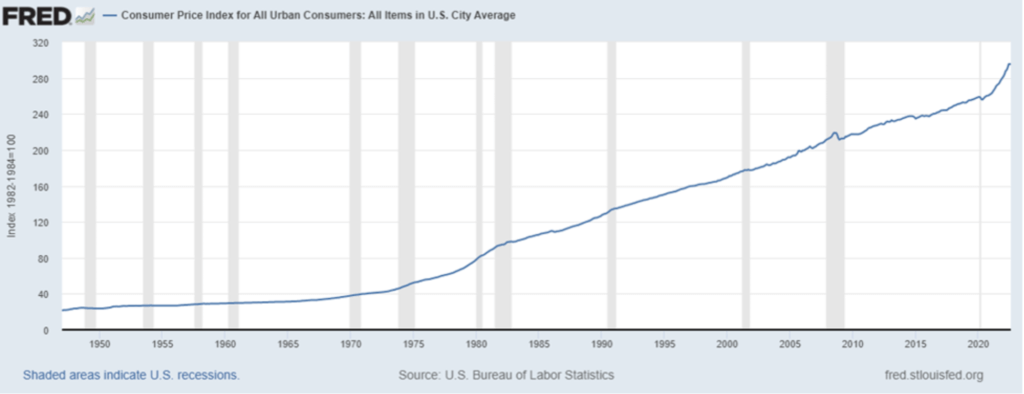

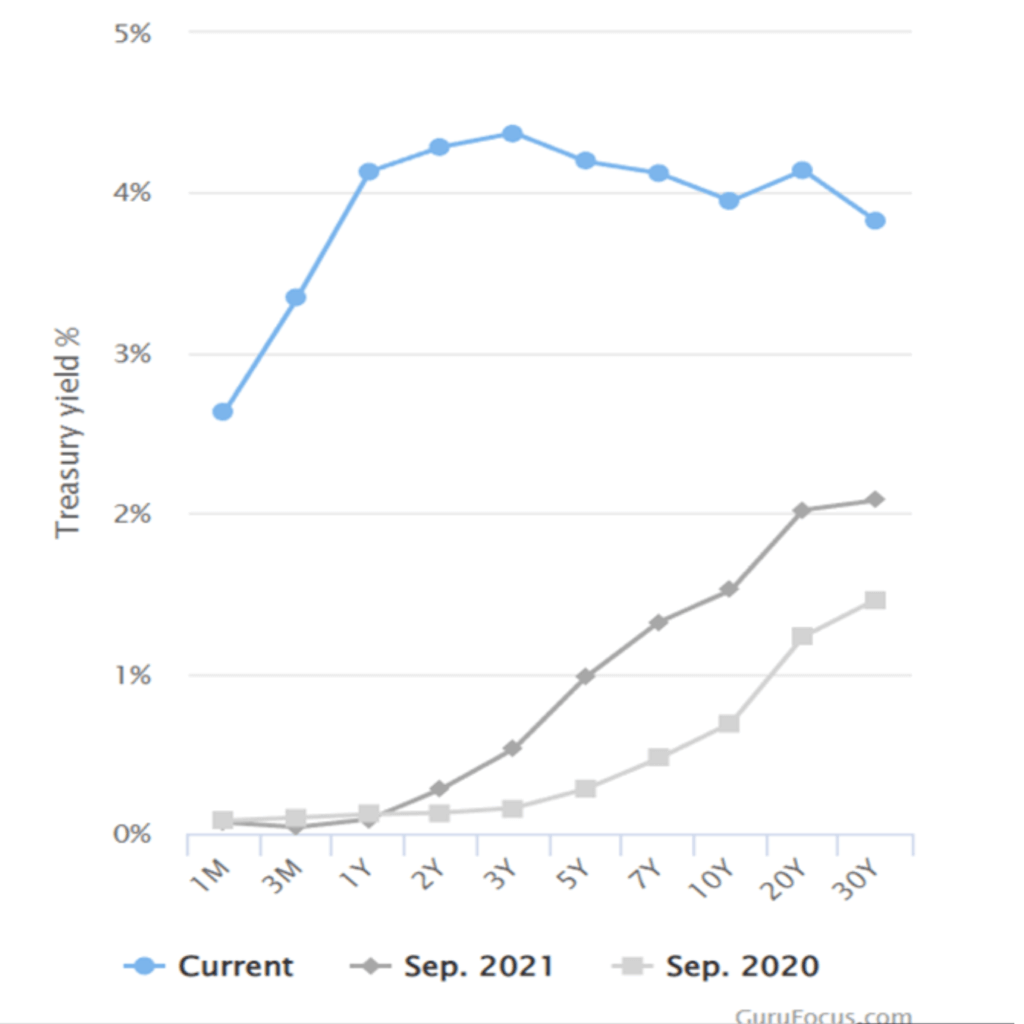

This is key, since profitability is based upon spread, not interest rates. This is absolutely the best time for an institution to perform core deposit analysis, as well as engage in strategic discussions with advisors. How you navigate the pricing on both sides of your balance sheet will determine how effectively you can take full advantage of the opportunities of this rising-rate cycle.

Lean on innovation.

Innovation has created challenges for financial institutions by way of increased types of competitors and products, and innovation can help you lead the pack. Are there products and/or services that you would “never” offer? Markets that you would “never” enter? Pricing strategies that you would “never” employ? As my colleague Dave Koch routinely says, “Never is a long time.” Perhaps now is the time to re-evaluate these options to take full advantage of the changing landscape during this cycle to foster growth in a rising-rate environment.

Use technology to get ahead of the pack.

Use technology to get ahead of the pack.

With uncertainties tied to how inflation and the Fed’s moves will impact the U.S. economy into 2023, a natural impulse might be to postpone advancing the digital transformation that institutions have accelerated since COVID. That type of move might seem quick and easy, but it is not clear-headed thinking. Now is the time to access the technology that makes staff more efficient, that gives you more visibility into performance and risk, and that pleases customers or members so much they will not consider going to a competitor or a fintech.

Now is the time to be stress testing liquidity levels thoroughly.

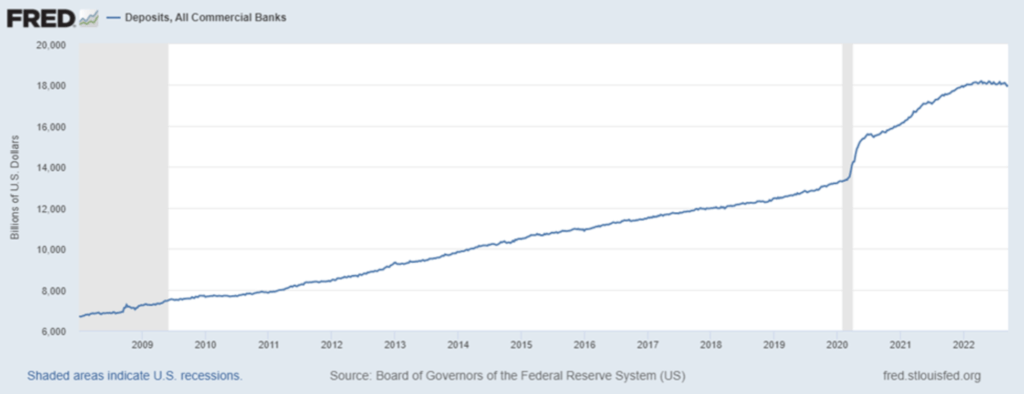

Do not wait until liquidity becomes an issue in your institution to stress test and begin liquidity conversations. Historically when rates are high, there is less liquidity. While addressing liquidity proactively is not necessarily a growth move, it is financially smart because it avoids having to look for other, potentially more costly forms of liquidity in the future.

Earlier I mentioned slowdowns in cash flowing back into financial institutions in both the investment and loan portfolios as well as the possibility and ease of deposits leaving to chase yield. Add to this the possible loss of principal from credit issues, and the excess liquidity that we have seen can evaporate quickly.