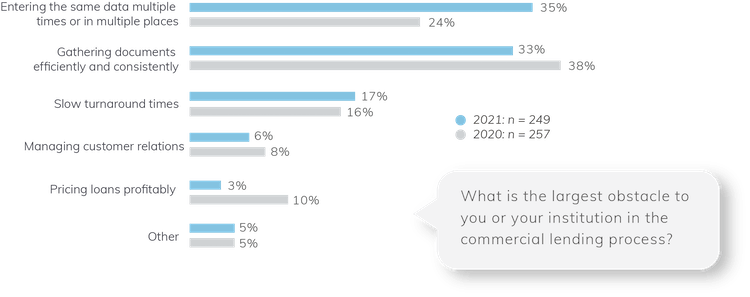

One example of processes that add costs, create delays, and make staff work too hard is repetitive data entry. Indeed, entering the same data multiple times or in multiple places was most frequently named as the largest obstacle to respondents or their institution in the commercial lending process. Thirty-five percent of those surveyed identified repeated data entry as the largest lending obstacle.

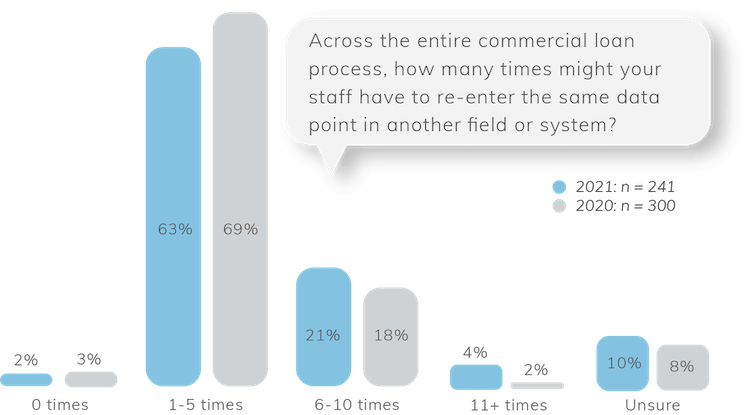

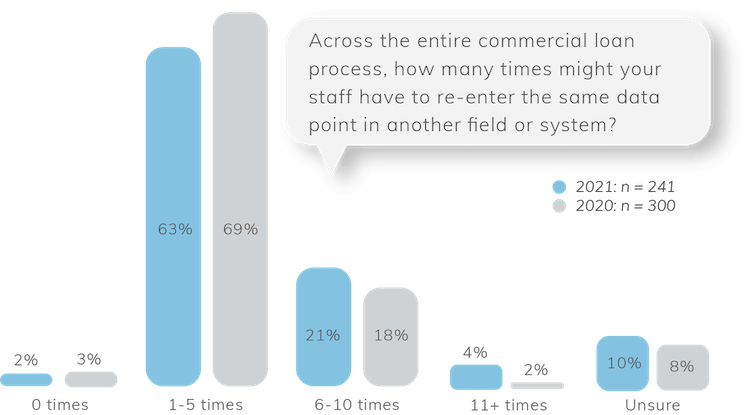

What’s the magnitude of repetitive data entry in business lending? Nearly two-thirds of respondents said their financial institution re-enters the same data point for a loan in another field or system up to five times. A quarter of respondents reported entering the data at least six times. In a similar survey by Abrigo in 2020, 20% of respondents said they entered data at least six times.

In addition, only 1 of every 3 respondents in Abrigo’s survey this year said their institution currently offers the ability to apply online for a commercial loan. Lenders with online applications are often able to port the borrower data across the origination platform, resulting in less repeat data entry. The good news is that a higher share of survey participants this year said they offer online business loan applications than did last year, when only 20% offered them. However, this year there were still 13% of respondents who said their institution doesn’t offer or plan to offer online loan applications in the future.

Manual credit memo = more time

Another process typically tied to repeated data entry is the credit memo – unless it is automated.

Only 7% of financial institutions in Abrigo’s survey reported using an automated solution to generate the credit memo. Instead, nearly half said their institutions enter this critical information manually. Another 42% reported using a combination of manual and automated methods.

Manual credit memos were most prevalent among the largest institutions in Abrigo’s survey this year. Two-thirds of respondents from institutions with assets over $10 billion reported entering credit memo information manually, and the other third reported using a combination of automated and manual systems.

When a credit analyst must manually input consolidated borrower information, financial ratios, any global cash flow analysis, the assigned risk rating, proposed loan pricing, and terms of the proposed loan to create a credit memo the loan committee can review, they are often inputting data from disjointed systems over and over. Even using institution-created templates might not eliminate the need to cut-and-paste data, review for errors, and rewrite certain sections, depending on the template and loan. This time spent on administrative tasks throughout the life of the loan ultimately reduces the time an analyst can spend analyzing a business loan. Another potential consequence could be a longer processing time for business loans.

'Speed and consistency make or break a deal'

“Process automation is incredibly important in today's lending environment,” said Brandon Quinones, Abrigo’s Director of Client Education. “Speed and consistency will make or break a deal, so putting a system in place to drive that automation—enabling financial institutions to spend less time on redundant data entry or requests and more time on value-add activities—is something industry leaders recognize as no longer just an option for their business.”

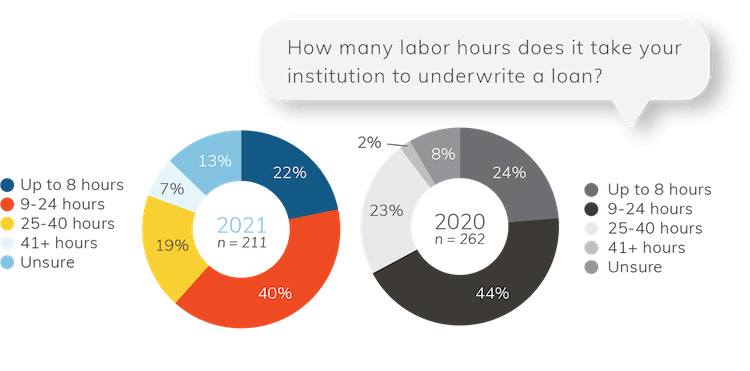

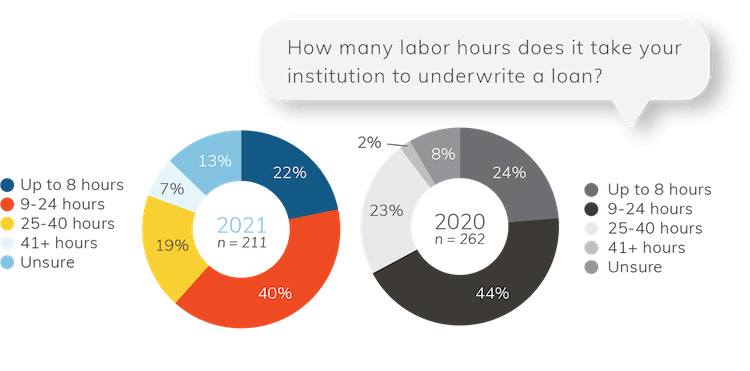

Forty percent of bankers said it takes their institution between 9 and 24 hours to underwrite a loan. While 22% said their institutions could complete underwriting in less than a business day, another 19% reported a 25- to 40-hour window, and 7% said underwriting can take more than 40 hours.

Including all processes, 46% of respondents said their financial institutions take at least five weeks to close a commercial loan. That figure includes many institutions (16% of respondents) requiring eight weeks or more.

Of course, banks or credit unions that focus on commercial real estate loans, which often require appraisals and entail more intense scrutiny than a small line of credit, tend to have longer turnarounds. However, the long wait time for a credit decision is historically the chief complaint among borrowers using small banks and credit unions for financing. And with the economic outlook improving, lenders looking to grow the business loan portfolio in the quarters ahead with credit-worthy borrowers will face tight competition for them.