Regulator comments on overseeing concentration risk

Concentrations often arise naturally for community banks and credit unions due to the types of businesses and industries that they serve in their communities. A bank in an urban corridor might understandably have a CRE credit concentration. A rural credit union might amass numerous agricultural loans.

Concentrations can also develop from over-exposure to specific borrowers, collateral types, or loan products. Concentrated credit exposure may build gradually. But a shift in rates, asset values, or borrower conditions can quickly turn that exposure into vulnerability. “Concentration risk must be managed in conjunction with credit, interest rate and liquidity risks; as a negative event in any category may have significant consequences on the other areas, as well as strategic and reputation risks,” says the NCUA.

The Fed’s June 2024 Community Banking Connections newsletter noted that concentration risk, particularly commercial real estate (CRE) risk, has remained a central supervisory focus since the Great Recession—and recent history has added a new layer of urgency.

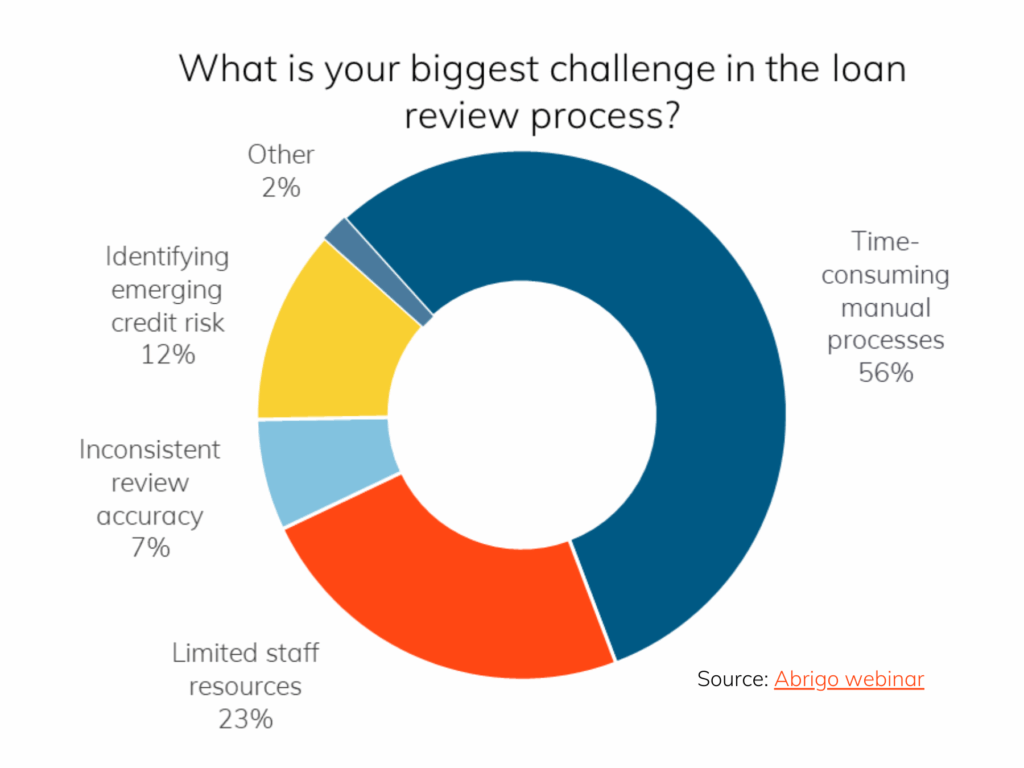

Banks’ relative exposures to CRE (as a share of assets) increased in recent years, according to the St. Louis Federal Reserve. In addition, charge-off rates on CRE loans (excluding farmland) have increased from 0.02% in Q4 2022 to 0.26% in Q4 2024, FRED economic data from the St. Louis Fed shows. During a recent Abrigo credit risk webinar, 51% of bank and credit union credit risk professionals responding to a poll reported an increase in problem loans over the last three months, and 42% said their borrowers are seeing declining economic conditions.

The newsletter for community bankers also noted that the 2023 failures of Silicon Valley Bank and other regional institutions highlighted the dangers of unmonitored deposit concentrations, emphasizing that concentration risk isn’t limited to the asset side of the balance sheet.

Indeed, managing asset concentration is among the areas that “have become top priorities for regulators,” wrote Andrew Giltner, Lead Examiner within the Chicago Fed’s Supervision and Regulation Division, in the Community Banking Connections newsletter.

The regulatory message for financial institutions is clear: Know where you’re concentrated, understand the risk dynamics, and maintain the capital and oversight necessary to weather downturns.