Managing loan workouts is a chief concern among banks and credit unions these days.

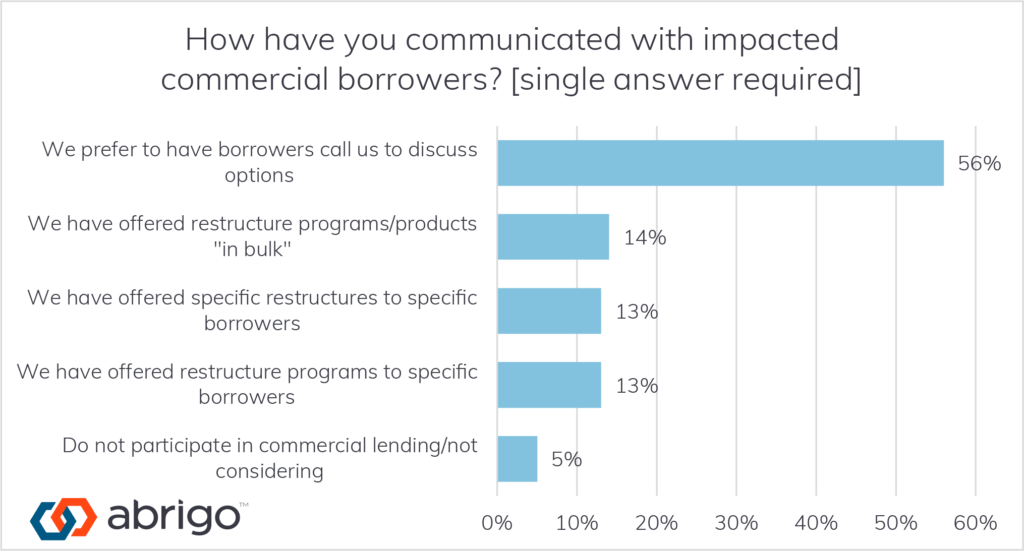

During a recent webinar hosted by Abrigo, 14% of attendees said their institutions had offered restructuring programs in bulk to commercial borrowers since the pandemic began (see chart below). However, most lenders (56%) said they preferred having commercial borrowers be the ones to reach out first to discuss loan options.

Now, as temporary modifications come to an end or in other cases, conditions have worsened for borrowers, lenders previously focused on handling Paycheck Protection Program loans are turning concerted attention to managing loan workouts. Financial institutions must consider what’s next for many of their commercial loans – whether it’s another modification or moving the loan toward a status of troubled debt restructuring, or TDR.

This need to manage what’s expected to be a large volume of loan modifications is just the latest complexity for lenders in 2020. But while this year’s tumult has meant long hours for many bankers, it has also created openings to solidify relationships with borrowers and address the needs of communities in which financial institutions operate, said Regan Camp, Managing Director of Abrigo’s Advisory Services.

This need to manage what’s expected to be a large volume of loan modifications is just the latest complexity for lenders in 2020. But while this year’s tumult has meant long hours for many bankers, it has also created openings to solidify relationships with borrowers and address the needs of communities in which financial institutions operate, said Regan Camp, Managing Director of Abrigo’s Advisory Services.

“We have a unique opportunity to continue to play in working toward a strong recovery and mitigating the impact along the way to both our respective institutions as well as to the borrowers that we serve,” he said.