High inflation rates, lingering supply chain issues from the pandemic, and war in Ukraine impacting oil and agricultural commodity prices are all challenges creating a less stable market than in years past. But uncertainty can give financial institutions opportunities to distinguish themselves through commercial loans, which have remained strong through the pandemic. With the right strategies and risk mitigation protocols, banks and credit unions can expand their commercial loan portfolios successfully.

Strategies for growing commercial loans

August 30, 2022

Read Time: 0 min

Expanding the commercial loan portfolio in today's market

With the right strategies, banks and credit unions can expand their commercial loan portfolios successfully.

Takeaway 1

Commercial loans have remained strong through the pandemic despite high inflation rates and unstable conditions.

Takeaway 2

With high net interest margins, high real estate values, and lack of alternative markets to invest in, the time is right for commercial loans.

Takeaway 3

Risk mitigation is essential to understanding the impact of lines of credit on profitability and allowance.

Market conditions

Current rate and market conditions

Knowing the why

Determining the reasons behind growth initiatives

There are several benefits to expanding the commercial loan portfolio in today's environment, according to Abrigo Senior Advisor Rob Newberry.

- Typically, financial institutions can get a higher net interest margin opportunity when they book a loan than they can by buying an investment. In a rising-rate environment, it can be difficult to sell and profit from investments that have been locked in for a set term and profit. Rather than buying more investments and incurring unrealized losses, growing the commercial loan portfolio can lead to a greater return on assets (ROA) or return on equity (ROE).

- Collateral-backed real estate loans and high property values make commercial real estate a worthwhile investment in these inflationary times. Commercial real estate (CRE), like other tangible assets, tends to appreciate in value proportionate to inflation, so while it is important to be careful of bubbles in certain markets, these loans could be a great investment.

- The lack of alternative options in a rising-rate environment may be a factor when deciding to expand into commercial lending. With bond markets down and low Treasury yields, there are few other places institutions can put money into and get a return.

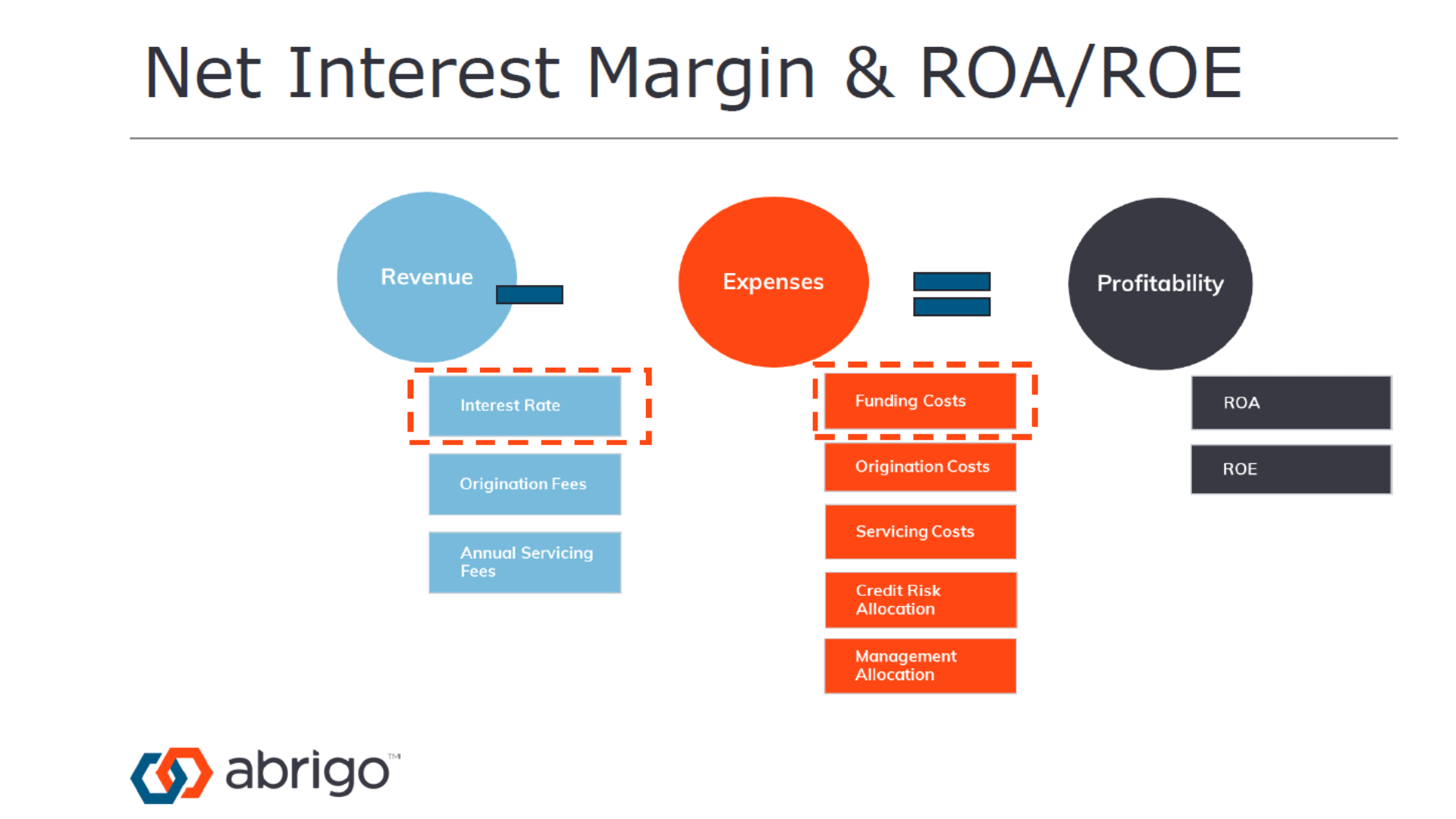

Before increasing commercial loans, think through their profitability and ensure prices set by your institution make sense using the following guide. The net interest margin is a main component of ROA and ROE calculations. Interest rates generate most of the net interest margin, while funding costs, depending on how they are migrated with the increasing fed rates, are the biggest expense. During Abrigo’s Strategies to Growing Your Commercial Loan Portfolio webinar, Newberry posited the following chart to help visualize the calculation:

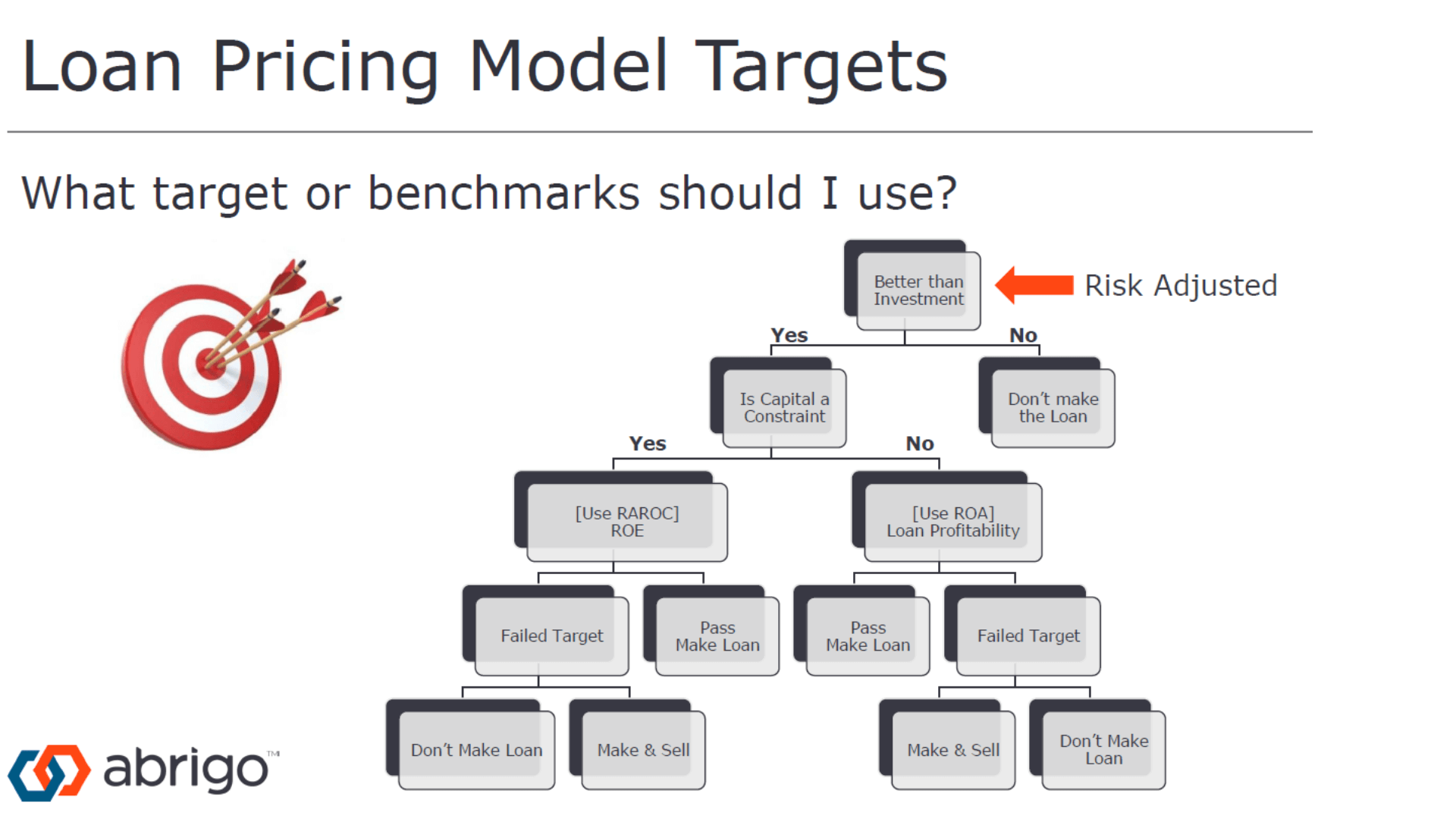

According to Newberry, the first question an institution should ask itself when pricing commercial deals is whether it is a better choice than an investment once credit risk is factored in. With liquidity rates what they are today, that may be an easy “yes.” From there, decide whether to use ROA or ROE to calculate price. Finally, ask if the loan as priced will meet your institution’s target ROA or ROE expectation. If it will be a profitable move, make the loan. Reference the flow chart below to ensure consistency with these decisions.

Learn more about credit risk in a rising-rate environment in this video podcast.

Listen nowCommercial growth strategies

Leveraging retention strategies and purchase options to supplement organic growth

Retention strategies like matching rates or terms and proactively managing customers can effectively keep customers at your institution, and, in some cases, help to grow their commercial loans with you. However, keep in mind that it is essential to have healthy turnover. Knowing when to walk away from a loan and understanding the full implications of certain retention strategies (such as the sacrifices made to rate match with a competitor or create a long-term fixed contract to retain a client) are important.

Other strategies to grow your commercial portfolio include:

- Developing unique products. When an institution carries the same loan product offerings as every other institution in its market, commodity pricing can be hard to break away from. But if an institution can brainstorm a unique product offered nowhere else, the greater premium is theirs for the taking. Be creative with commercial products and features that might drive customers to see a higher perceived value than the cost of the product to your institution.

- Consider adjusting your financial institution’s interest rate floor. In this rising-rate environment, floors are not necessarily moving in lockstep with interest rates. Update your floors based on the current rates and understand the risks of floors—if rates continue to go up, it should trigger a rise in financial institutions’ rates as well.

- Originate or purchase participation loans. For financial institutions with high liquidity but low loan demand, participation loans might be a good idea to diversify the type of loans in your institution. A recent poll of Abrigo’s audience reported that 39% of banks are routinely reviewing participation opportunities. Another 21% would explore them under the right circumstances, and 23% would consider participation loans with specific trusted partners. Participation loans were given a bad name after the financial crisis of 2008, but with the proper due diligence, banks and credit unions can leverage them to help grow their loan portfolios, Newberry said.

Risk management

Keys to mitigating risk

Any financial institution looking to grow the commercial loan portfolio should keep in mind that proper credit risk management remains critical.

Whether it is required or not, banks and credit unions should perform stress tests regularly to identify changes in the risk profiles of segments and loans. Stress test when assigning credit risk in one of two ways:

Enterprise-level stress testing is a method that considers multiple types of risk and their interrelated effects on the overall financial impact under a given economic scenario. These risks include but are not limited to, credit risk within loan and security portfolios, counter-party credit risk, interest rate risk, and changes in the bank’s liquidity position.

Reverse stress testing is a method by which the bank assumes a specific adverse outcome, such as suffering credit losses sufficient to cause a breach in regulatory capital ratios. The institution then deduces the types of events that could lead to such an outcome. This type of analysis (e.g. a “break the bank” scenario) can help a bank consider scenarios beyond normal business expectations and challenge common assumptions about performance and risk mitigation strategies.

To further mitigate risk, institutions should understand the impact of lines of credit on overall profitability and the allowance. Price each opportunity based on the risk assumed with the loan, and be sure loans are priced high enough to cover the bank’s credit risk over the entire life of the loan. Banks and credit unions should also consistently apply objective-based risk scoring models and consider using global cash flow analysis to see the big picture of their ability to service the proposed debt.

The most common use cases of when global cash flow analysis should be completed by a lender are:

- When dealing with complex credits with multiple related business entities

- To assess the real value of personal guarantees on commercial loans

- When banks have concerns about the potential for an entity’s commingling of personal and business funds.

These risk-mitigating processes, along with sound strategy and the right environment, can help your financial institution get ahead of the competition in the commercial lending field.

Learn more about effective loan policy with this guide

conduct a loan policy tune-up Keep me informed

About the Author