Challenges and Opportunities for SBA Lending at Community Banks

For entrepreneurs, start-ups, and growing businesses seeking funding for their enterprise, Small Business Administration 7(a) loans are a popular choice. SBA loans are guaranteed up to 85 percent of the loan by the Small Business Administration. SBA loans allow these small businesses to borrow money for a variety of business purposes, from purchasing inventory or equipment, to buying real estate. Due to low interest rates and flexible terms, SBA loans are one of the most sought-after types of financing for small businesses.

If you’re a small business owner looking to obtain one of these loans, there’s a good chance you’re going to a community bank to get one. In March 2019, the approval percentage for small business loan applicants hit a record high of 27.3 percent at big banks; small banks, on the other hand, have an approval percentage of nearly 50 percent (49.4). Small business loans have been called the “lifeblood” of community banks. While they only hold 13 percent of all industry assets, community banks account for 42 percent of small business loans. According to the 2018 Community Banking in the 21st Century survey, 91 percent of community banks reported small, midsized, or regional banks to be their primary competitor for small business loans. Only two percent of those surveyed reported large banks (more than $50 billion in assets) being a primary competitor. SBA loans, in particular, are offered by nearly 70 percent of community banks, the same survey reports.

Drawbacks to SBA loans

If borrowers are looking to get money in their hands as soon as possible, SBA loans may not be the best route to take. A major drawback for SBA loan applicants is the extensive amount of time and paperwork required to apply. On top of the extensive amount of time it takes to submit an application, it can take, on average, 60 to 90 days from the initial application to the release of funds. A customer can spend months going back and forth with their bank trying to get the necessary paperwork and documentation together…and still get turned down. In fact, the Federal Reserve found that the average small business borrower spent more than 25 hours on paperwork for bank loans.

There are four main stages of the SBA loan application process, as Fundera outlines:

- Borrower gathers documents, applies for loan (1-30 days)

- Lender underwrites loan (10-14 days)

- Lender approves the loan, sends commitment letter (10-21 days)

- Lender closes on the loan (7-14 days)

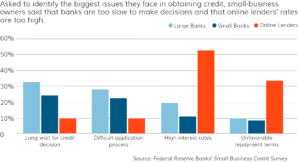

Customers needing money in their hands faster for their small business needs have started turning towards online lenders. While online lenders can’t match the same favorable repayment terms or low interest rates that smaller banks can, online lenders have found a distinct advantage in the speed of their decision-making.

Customers have the need for speed, and banks are listening

Banks aren’t too concerned about losing less credit-worthy borrowers to alternative lenders; however, they are worried about losing creditworthy customers who have been “seduced by the speed and ease that alternative lenders are pitching,” noted David O’Connell, a Senior Analyst at Aite Group, in an American Banker article. Because of this, banks are looking for – and implementing – new technology to create a more efficient lending experience for small business loans.

Remember the 10 to 14 days a bank could spend underwriting an SBA loan application? Today’s technology affords smaller banks the opportunity to streamline the underwriting process by creating online loan applications and avoiding mounds of paperwork and documentation, reducing redundant data entry, and automating analysis.

SBA loans are being approved at big banks at rates that haven’t occurred since the beginning of the Great Recession. For smaller banks that rely on small business loans for profitability and growth, it will be increasingly important to ensure that small business loans stay at the community banks. As SBA loan technology becomes more readily available for smaller financial institutions, these institutions must take advantage of the time- and cost-savings that SBA technology can bring their borrowers and their lenders.