This article is substantially updated from a 2013 blog post.

3 Keys to Effective Loan Review

December 1, 2021

Read Time: 0 min

How to make loan review more effective

When it comes to loan review, there are three key areas to help ensure a more effective process.

Would you like other articles like this in your inbox?

Takeaway 1

The organizational structure of the loan review process must reflect independence and objectivity.

Takeaway 2

It's imperative that FI senior management demonstrate commitment to a robust loan review program.

Takeaway 3

The scope must be defined in advance for a loan review to provide value and meaningful data.

There will always be risks inherent in loan portfolios, and effective portfolio management and loan control functions are critical to the overall risk management function of banks and credit unions. The loan control function is typically spread over three functional areas within the institution: credit administration, audit, and loan review. When it comes to loan review, there are three key items to help make the process more effective.

Step One

Independence or objectivity

Without question, the most important key to an effective loan review program is ensuring its independence and objectivity, and the organizational structure must reflect this independence.

The primary consideration for organizing the loan review function is determining whether the function will be performed by an internal department or completed externally by a third party, such as a loan review or consulting firm. Institutions could benefit from a hybrid loan review approach, combining an internal loan review process with a periodic external review. In a hybrid approach, loan review consultants work alongside an institution’s internal program to provide a risk assessment with an outside perspective, along with an evaluation of overall credit administration. Regardless of how the loan review function is organized, it’s paramount that the loan review function remains objective.

The review of loan risk ratings and grades provides a clear example of why objectivity is so critical to an effective review process. Banks are required by regulators to have formal risk rating policies in place to determine how ratings are assigned. These grades are one of the primary measures in stratifying the loan portfolio, and they have a direct impact on loan pricing and the reserve for loan loss.

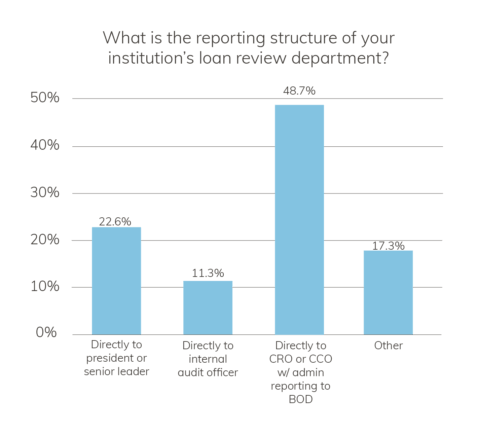

In a recent Abrigo survey, nearly half of survey respondents said that their institution’s loan review department reports directly to the Chief Risk Officer or Chief Credit Officer, or the board of directors. Meanwhile, 23% of respondents report directly to the President or Senior Lender, and just 11% report directly to internal Audit Officers.

Learn how to analyze and approve loans more quickly.

Get more information

Step Two

Commitment from senior management

In any organization, the tone and culture are always set at the top. That’s why it is imperative that senior management in banks and credit unions demonstrate their commitment to a robust loan review program in order for it to be successful.

Ancin Cooley, principal of Synergy Bank Consulting, states, “If asked about the importance of their loan review function, senior management is likely to tell you how vital it is to their overall risk management process. However, their commitment to the loan review function is best reflected by organizational placement, compensation structure, and integration in the financial institution’s credit culture.”

Regulators say the board of directors or an appropriate board committee will review and typically approve at least annually a written credit risk review policy “to demonstrate its support of, and commitment to, maintaining an effective [credit risk review] system.” Some institutions might refer to the policy as a loan review policy or loan review charter.

An effective credit risk review charter addresses:

- a description of the overall risk rating framework

- responsibilities for review

- the qualifications and independence of credit risk review staff

- the frequency, scope, and depth of reviews

- the review of findings and follow-up

- communication and distribution of results

Step Three

Defined scope of the review

For a loan review to provide value and meaningful data to the institution, the scope of the review must be clearly defined in advance. Both the staff performing the review and the end-users of the results (management and the board of directors) need to have a clear picture of what is and what is not included in the review. There are several issues to consider here, such as the loan sample, the consumer loan portfolio, and documentation review. The board or an appropriate board committee typically approves the scope of the review annually or when significant changes occur.

What is a properly defined scope? It considers:

- current market conditions

- other external factors that may affect a borrower’s current or future ability to repay the loan

- whether the sample is representative of the portfolio as a whole

- whether the sample provides reasonable assurance that credit quality deterioration or unfavorable trends are identified

A properly defined scope will help identify which credits are to be examined, as well as the depth of the review.

About the Author