Comparing the WARM method to other CECL approaches

WARM method vs. SCALE

Both WARM and the Federal Reserve’s SCALE tool (Scaled CECL Allowance for Losses Estimator) are intended to help estimate the ACL for less complex entities or those with less complex financial asset pools. As a result, both methods appeal to community banks and credit unions. However, they serve different needs and have some important differences.

- SCALE leverages peer data, which may ease data requirements for banks with limited internal loss history. The regulators and auditors still expect institutions to adjust for their own experience, which can be challenging and hard to support.

- WARM can also use peer data, but it allows for greater use of internal data and portfolio-specific risk segmentation. It also offers more customization, which requires documentation.

Other considerations when it comes to comparing SCALE and the remaining life method:

- SCALE relies on proxy expected lifetime loss rates of peers, which are already adjusted for reasonable and supportable forecasts. Management should consider whether a qualitative adjustment should be applied to account for local economic conditions expected to perform better or worse than industry economic conditions.

- The peer data used for SCALE would typically be based on information from the previous reporting period. Management should consider the timing issue and determine the impact of any changes in business or economic conditions as between when proxy loss rates were calculated and the reporting date.

- Regulators have said the SCALE tool is not appropriate for institutions with assets greater than $1 billion that are required to submit data into Schedule RI-C since that would result in an institution both submitting data and using data derived from Schedule RI-C.

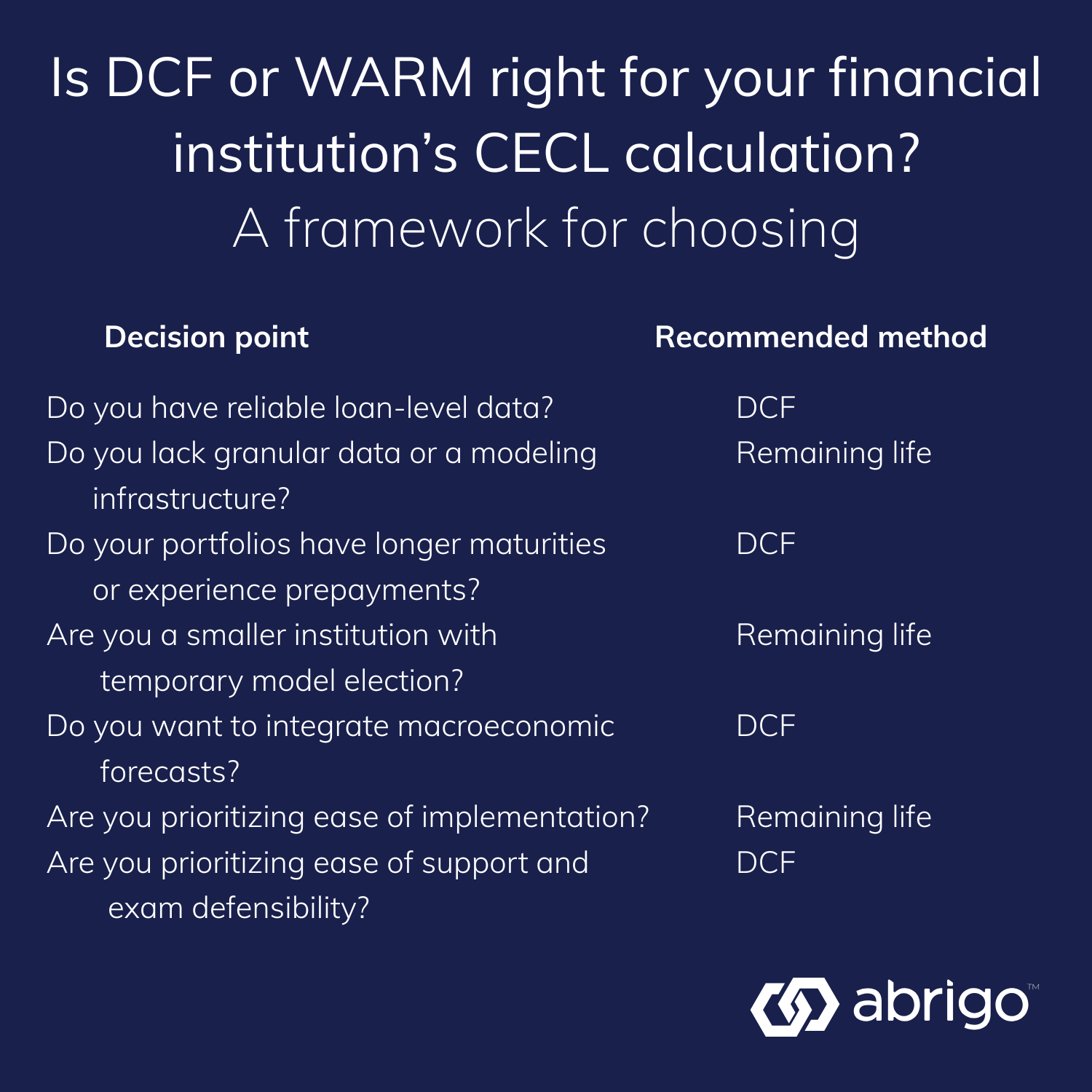

WARM vs. discounted cash flow and static pool models

WARM, discounted cash flow (DCF), and static pool methods all comply with CECL, but they vary greatly in data requirements, forecasting precision, and operational complexity.

- Discounted cash flow models simulate individual loan cash flows using assumptions for prepayments, default timing, recovery rates, and discount rates. They provide high granularity and allow institutions to align economic forecasts with precise time periods, which can be a key advantage when forecasting near-term economic volatility or credit deterioration.

- Static pool or cohort-based models track over time a defined group of loans originated during a given period, measuring cumulative loss behavior. Static pool methods conceptually align with CECL’s lifetime loss perspective, but they require longitudinal, loan-level data and robust cohort tracking practices.

By comparison, WARM estimates credit losses using historical loss averages applied across the remaining life of the pool. It does not account for the timing of losses and treats the portfolio as a single amortizing asset. As a result, WARM is easier to govern and document but sacrifices modeling precision.

Considerations for use cases of each model type

WARM may be best for institutions with relatively simple, amortizing portfolios and limited access to life-of-loan data, or for less complex portfolios/segments, new lines of business, or immaterial acquired portfolios. It may be appropriate for specific types of loan portfolios, such as segments without losses or segments lacking loan-level data because they are serviced by a third party. A credit card portfolio is an example.

DCF and static pool models may be better suited for institutions with complex portfolios, short-term credit volatility, or regulatory pressure to align forecasts more tightly with exposure timing.

Trade-offs and limitations of the WARM method

As noted above, the WARM method is designed for clarity and feasibility. But that simplicity comes with trade-offs. Institutions using this approach should recognize its potential limitations and actively mitigate them through documentation and governance.

Challenges with data granularity and outliers

Because WARM is a top-down method relying on aggregated portfolio data, it lacks visibility into loan-level performance patterns. This can mask significant outliers or emerging risks within a pool. For smaller institutions or smaller segments, one or two charge-offs can skew the average charge-off rate, especially when loss histories are shallow or inconsistent.

Institutions should consider the statistical volatility of smaller pools and whether supplemental analysis or exclusion of outlier periods is needed to avoid distortions.

Situations where WARM may introduce oversimplification

WARM assumes straight-line balance reduction across the remaining life of the pool. While this simplifies exposure modeling, it often does not reflect actual amortization behavior. Products with balloon structures, revolving credit, or seasonal paydown patterns may not fit the straight-line assumption well.

Institutions using WARM should document how they determined remaining life and consider qualitative adjustments if actual repayment patterns materially diverge from the model assumption.

Balancing ease of use with accuracy

CECL requires incorporating reasonable and supportable forecasts, and WARM supports this through qualitative overlays and near-term forecast layering. However, because the method applies charge-off rates evenly over the remaining life, WARM lacks the ability to time forecasted risk precisely.

For example, if an institution anticipates elevated losses within the next 12–18 months due to deteriorating market conditions, the WARM method can’t easily front-load those losses. More granular methods like DCF or PD/LGD modeling are better suited to simulate time-based loss expectations.

When WARM may not be the best fit

The WARM method may not be appropriate for all loan types or portfolios. Institutions should reassess their methodology if they have:

- Newly introduced or unseasoned loan products without reliable loss history

- Complex structures (e.g., interest-only periods, variable-rate resets, or off-balance sheet exposures)

- Significant concentration risk in high-volatility asset classes

- Rapid growth into new markets with limited historical performance data

In these cases, WARM may oversimplify the credit risk profile, potentially leading to under- or over-reserving. If the institution cannot clearly tie the model assumptions to observed portfolio behavior, examiners may challenge the methodology’s adequacy.