This post by Hayley Collier, Trepp's Marketing Communication Specialist, was originally published on Trepp's blog and can be found here.

Trepp’s Head of Commercial Real Estate Finance, Joe McBride, whom readers and listeners may know from The TreppWire Podcast, spoke at Abrigo’s ThinkBIG Event recently. His presentation covered the current commercial real estate (CRE) performance and a look at the future of CRE. Here we have summarized the main takeaways from the session.

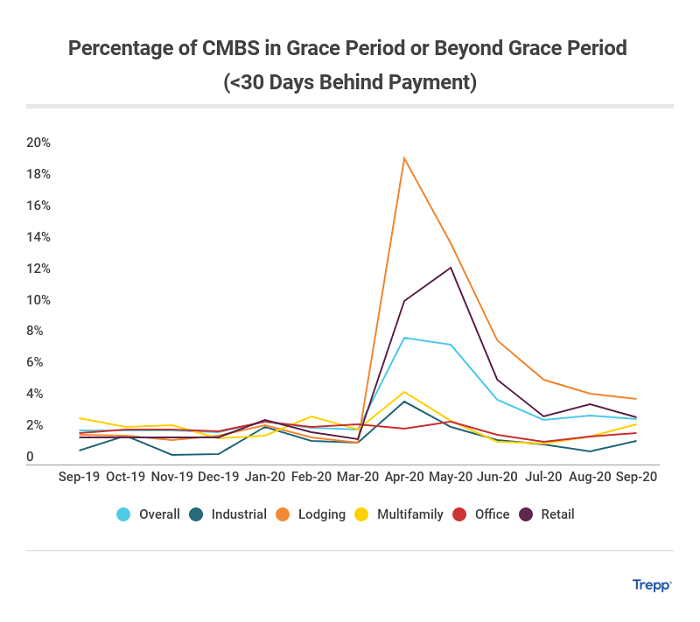

McBride’s presentation primarily covered the pandemic's impact on CRE. He began with a look at a Trepp chart which highlighted the percentage of loans in grace period on a monthly basis dating back to 2019. This was a new metric we began tracking in April, amid the disruption hitting the commercial mortgage market from COVID.

As McBride explained, the graph shows a relatively flat curve until March and April of this year, which is not surprising given that we started to see shutdowns at the end of February and into March. The greatest incline was represented in both the lodging and retail sectors, with lodging increasing to nearly 20% of the universe in grace period, and retail going up to just above 10%. These numbers did retract over the next few months, but McBride highlighted that this is not necessarily positive news as it appears, as the decline is likely because these loans transitioned into truly delinquent categories.